Products

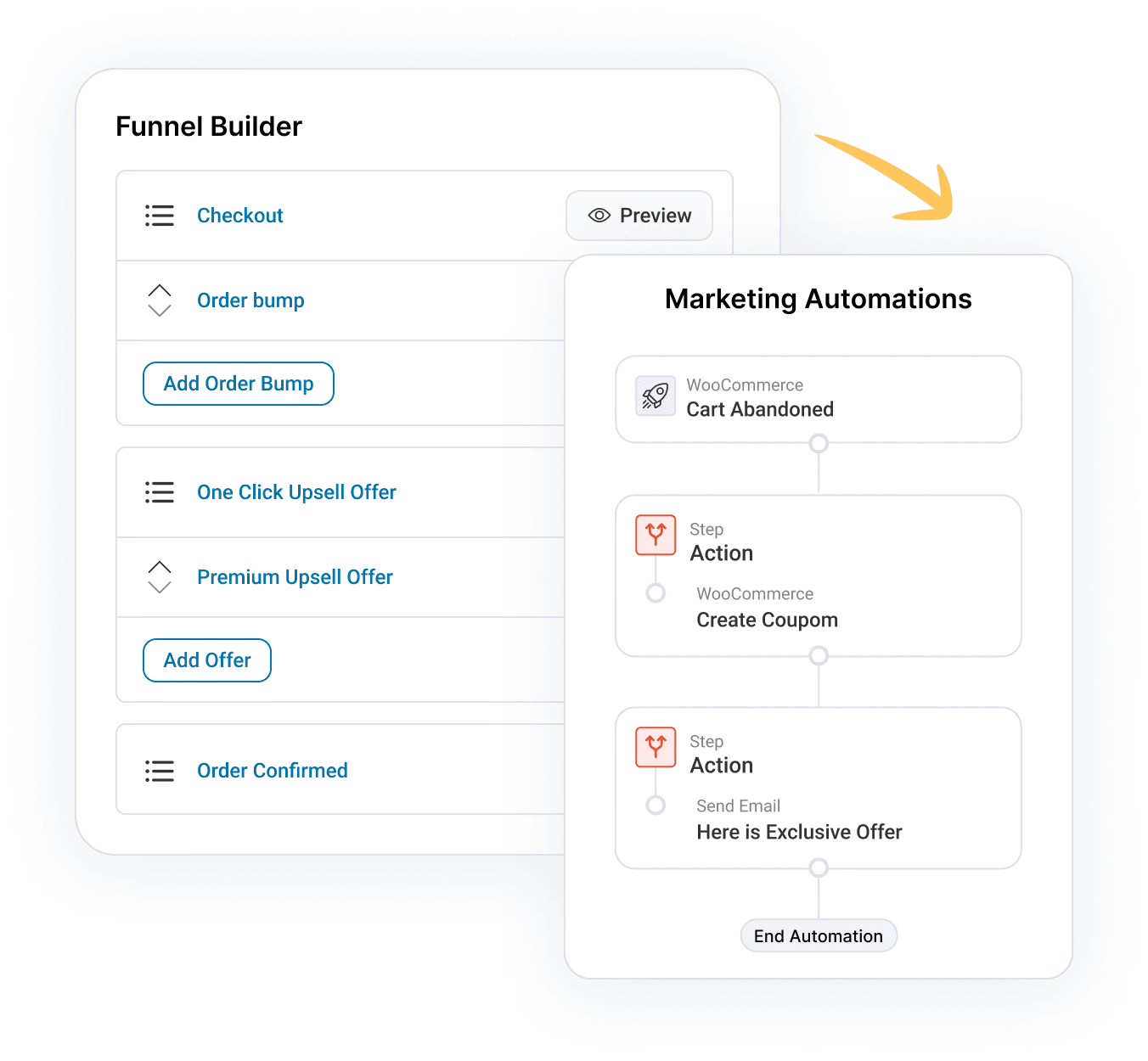

Funnel Builder

Build profitable funnels using conversion-friendly templates, analyse performance.

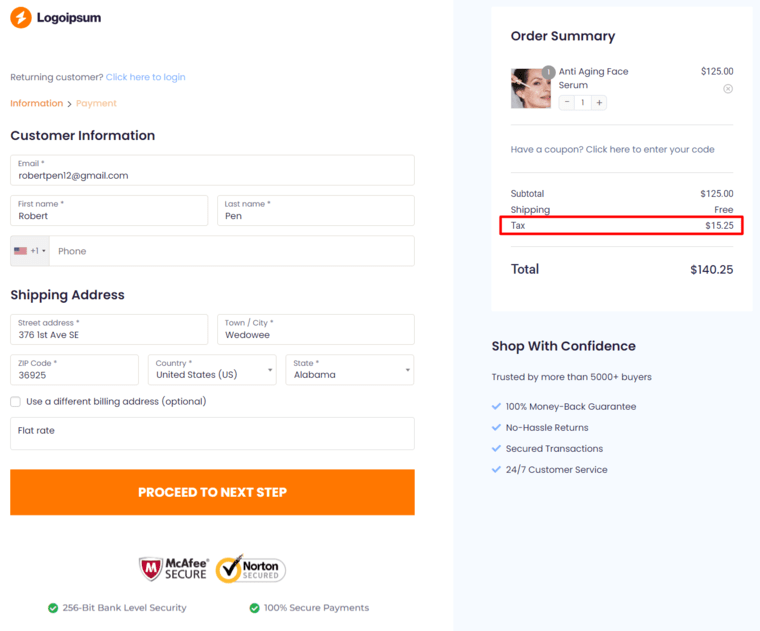

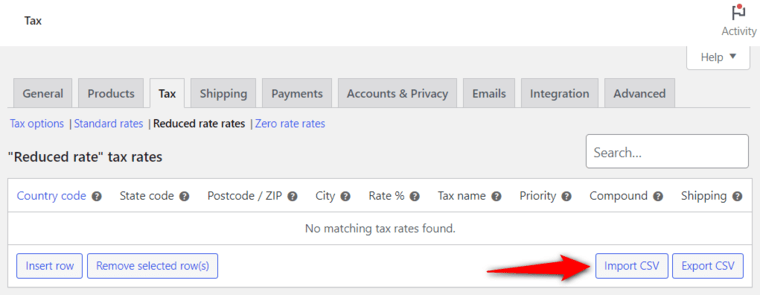

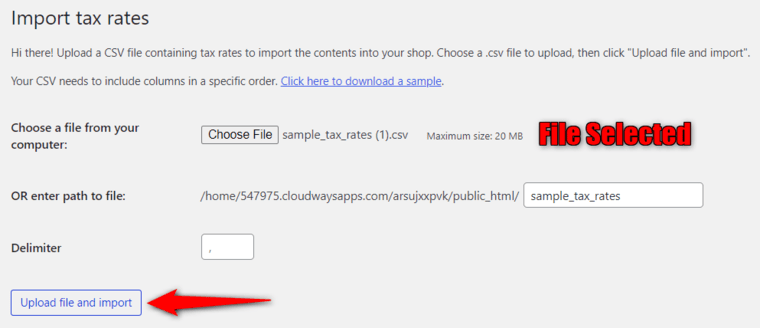

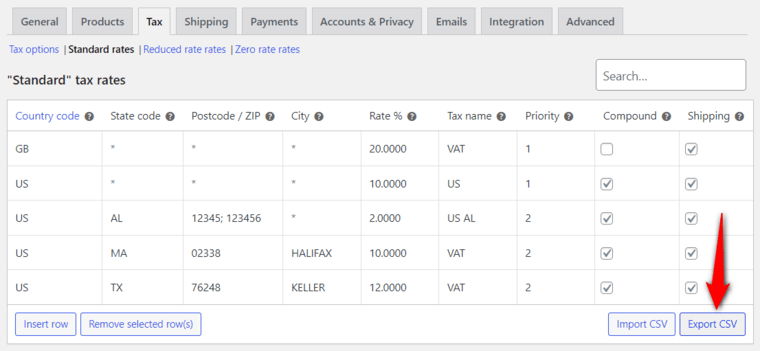

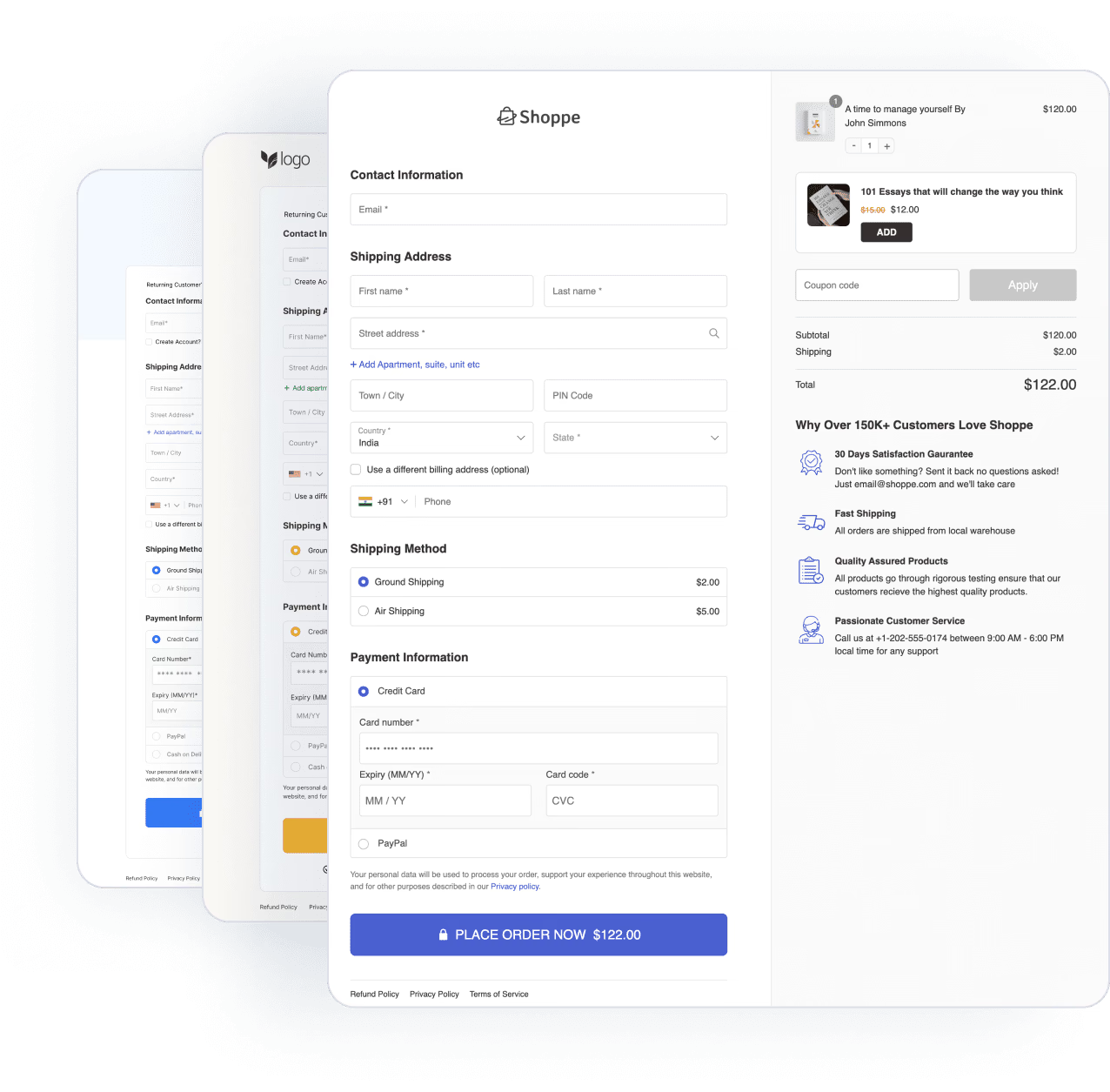

Optimized WooCommerce Checkout

One Click Upsells

Order Bumps

A/B Testing

Lead Generations

Analytics

Thank You Page

Marketing Automations

Create broadcast and automated campaigns without leaving WordPress.

Email & SMS Marketing

Rich Contact Profiles

Workflow and Integrations

Segmented Broadcast

Revenue Tracking

Transactional Email

Abandoned Cart Recovery

Sliding Cart

Meet FunnelKit's dynamic side cart—no more redundant pages!

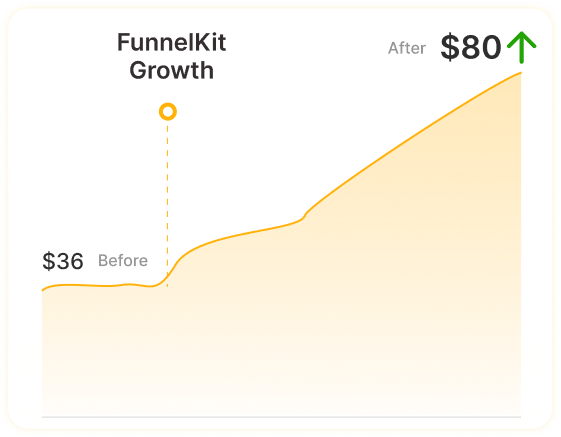

Boost Profits with Funnels & Automations

Over 899+ 5 star reviews show that FunnelKit users trust our top-rated support for their online business.

Pricing

Templates

Resources

Testimonials

Support

Leave a Reply

You must be logged in to post a comment.