Choosing the right payment gateway is one of the most important decisions for your WooCommerce store because it directly affects your sales, cash flow, and customer trust.

I learned this the hard way.

At the start of my journey, I set up a WooCommerce store for a supplement brand and picked a gateway without doing much research. It looked fine: easy setup, decent reviews, but the problems surfaced quickly.

Payouts were delayed by over a week, which choked our cash flow. Subscription orders had hidden fees that ate into margins, and the exchange rate charges were brutal.

Worst of all? The support was slow and ineffective when we needed urgent help.

Eventually, we tested over 15 different gateways and found a much better fit. The difference was night and day with faster payouts, lower fees, and a smoother experience for both us and our customers.

Lesson learned: your payment gateway can make or break your business. Don’t just pick what’s popular. Pick what actually fits your needs.

In this guide, I’ll walk you through the 7 best WooCommerce payment gateways for 2025, complete with features, pros, cons, pricing, and who they're best suited for.

Table of Contents

- 1 Top 7 Payment Gateways for WooCommerce: Quick Summary

- 2 7 Best WooCommerce Payment Gateways: The Ultimate List

- 2.1 1. Stripe: Best for Fast Onboarding, Modern Checkout & Global Reach

- 2.2 2. PayPal: Best for Brand Trust & Flexible Payment Options

- 2.3 3. Best for Native Payment Integration: WooCommerce Payments

- 2.4 4. Authorize.net: Best for Recurring Payments & Fraud Protection

- 2.5 5. Best for Unified Online and In-Person Selling: Square

- 2.6 6. Amazon Pay: Best for Fast Checkouts Using Saved Amazon Details

- 2.7 7. Best for Enterprise-Level Global Payments: Adyen

- 3 Geographic Coverage: Top Payment Gateways by Country

- 4 Frequently Asked Questions (FAQs)

- 5 Wrapping Up: Choose the Right WooCommerce Payment Gateway for Your Store

Top 7 Payment Gateways for WooCommerce: Quick Summary

Here’s a quick side-by-side comparison of the top WooCommerce payment gateways, ranked by their key features, pricing, availability, and currency support:

| Payment Gateway | Best For | Pricing | Supported Currencies | Available Countries |

|---|---|---|---|---|

| Stripe | Fast onboarding, SCA, 3D Secure, Apple Pay, Google Pay support, and more | 2.9% + $0.30 per transaction; +1.5% for international | 135+ | 190+ |

| PayPal | Encrypted Checkout, customizable API, PayPal Credit | 2.9% + $0.30 per transaction; +1.5% for international | 25+ | 200+ |

| WooCommerce Payments | Seamless integration with Woo, direct dashboard access, and more | 2.9% + $0.30 per transaction (for US); pricing varies by country | 100+ | 35+ |

| Authorize.net | Advanced fraud detection, recurring payments | 2.9% + $0.30 per transaction; $25 monthly fee | 20+ | U.S., Canada, Europe, Australia |

| Square | Free POS, real-time reporting, and inventory management | 2.9% + $0.30 per online transaction; 2.6% + $0.10 in-person | 8 | U.S., Canada, Australia, Japan, UK, Ireland, France, Spain |

| Amazon Pay | Trusted brand checkout, auto-filled customer details, fast login | No setup fee, 2.9% + $0.30 per transaction; 3.9% + $0.30 per cross-border transaction | 40+ | 150+ |

| Adyen | High-volume, global enterprise grade payments with strong fraud prevention | No setup fee; $0.13 fixed processing fee, added fee determined by the payment method | 150+ | 40+ |

What to look for in an ideal WooCommerce payment gateway?

Before diving into the top options, here’s what you should evaluate:

- Transaction fees: Free setup and low per-transaction charges

- Supported payment methods: Credit/debit cards, wallets (Apple Pay, Google Pay, etc.), BNPL, local payments, etc.

- Geographic coverage: Ability to handle multiple currencies and available in the regions you sell to.

- Security features: PCI-DSS compliant, end-to-end encryption, fraud detection and prevention, and secure authentication measures

- Ease of integration and usage: Easy-to-use interface and quick setup

- Customer support: Responsive customer support with dedicated documentation

- User experience: Fully optimized for both desktop and mobile checkouts.

We’ve established a ranking criterion, assigning scores on a scale of 0-100. Grades will be based on this scale, with an A grade for scores of 90-100 and a B grade for scores of 80-90, and so on.

7 Best WooCommerce Payment Gateways: The Ultimate List

Here are the top WooCommerce payment gateways I recommend based on hands-on experience and performance:

1. Stripe: Best for Fast Onboarding, Modern Checkout & Global Reach

| Best For | Accepting credit cards, subscriptions, mobile wallets, and stores needing developer-friendly APIs |

| Setup Fee | Free |

| Transaction Cost | |

| Ranking | A |

| Best Plugin | Stripe Payment Gateway for WooCommerce |

Stripe is my go-to payment gateway for WooCommerce, especially when mobile experience and speed matter.

It supports all major credit and debit cards, digital wallets like Apple Pay and Google Pay, Alipay, and even region-specific methods like iDEAL, Bancontact, SEPA Direct Debit, and more.

Stripe is extremely simple to set up with WooCommerce and supports over 135 currencies, making it ideal for reaching customers worldwide.

Standout features

- Seamless on-site checkout (no redirects to external pages)

- Mobile wallet support (Apple Pay, Google Pay, etc.)

- Buy Now, Pay Later options (Klarna, Affirm, and Afterpay/Clearpay)

- Advanced fraud prevention with Stripe Radar

- Fast payouts and transparent reporting

- Multi-currency support for international stores

- Integrates with WooCommerce Subscriptions and supports recurring billing

My experience

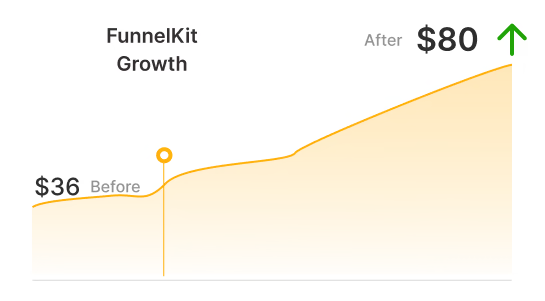

WooCommerce doesn’t have a built-in integration with the Stripe payment gateway. For that, I used over 11 WooCommerce Stripe gateway plugins, and my favorite is one by FunnelKit.

What I really like about this plugin is that it’s free and loaded with awesome features, such as quick onboarding and easy-to-use options, compared to other Stripe gateway plugins out there.

Pros

- Clean and intuitive checkout experience

- PCI DSS compliant, 2-factor authentication, and SCA-ensured

- Ideal for mobile-first shoppers

- Global payment support

- Integrates with WooCommerce and checkout builder plugins

- Developer-friendly API and easy documentation

Cons

- Standard processing fees may be high for low-margin stores

- Account holds may occur if Stripe flags high-risk transactions

- Limited in-person payment options unless using Stripe Terminal

My verdict

If you want a fast, secure, and conversion-focused payment gateway that “just works” with WooCommerce, Stripe is your best bet.

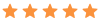

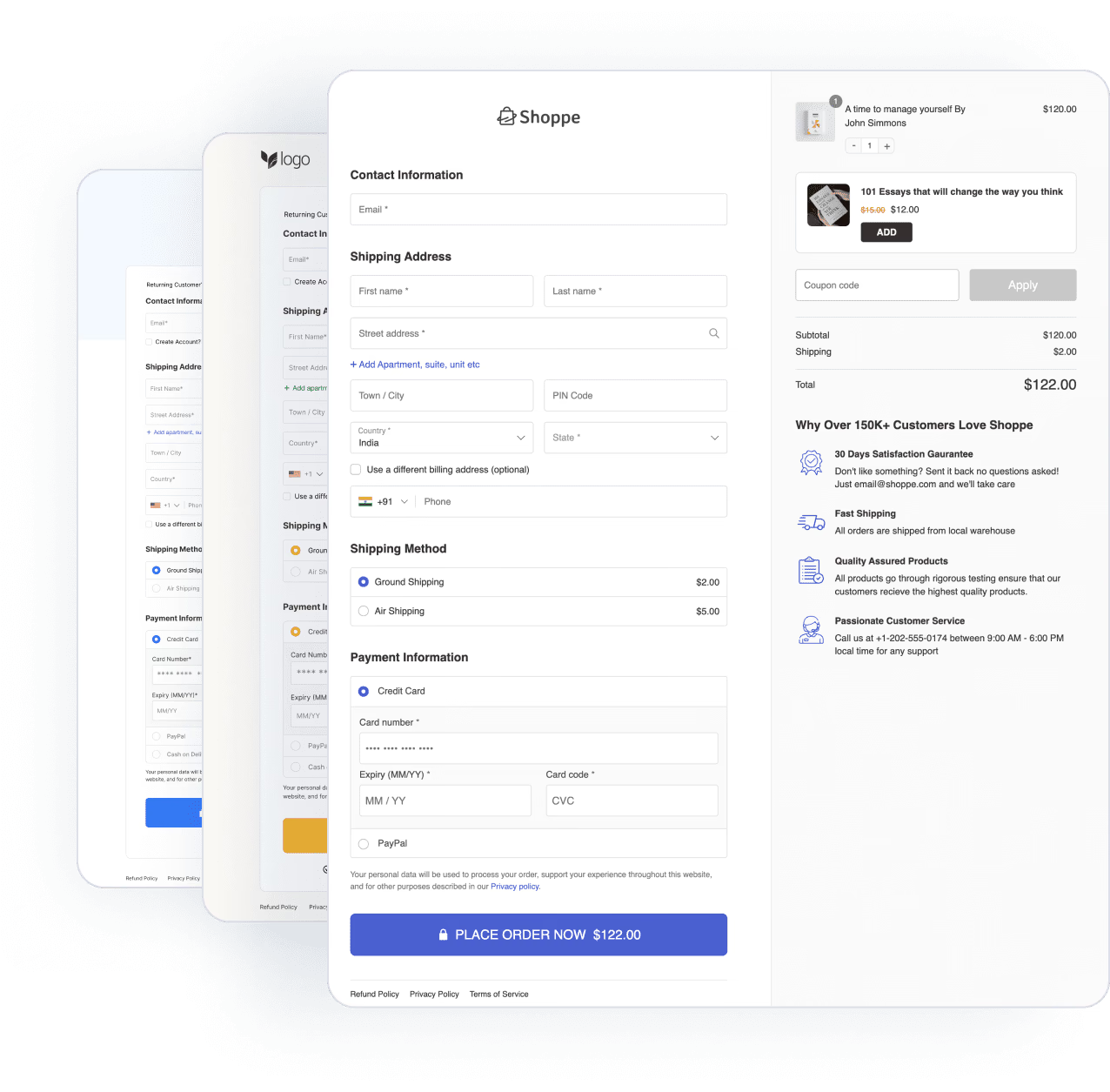

Combine it with a checkout optimization tool like FunnelKit to unlock powerful features like one-click upsells, collapsible checkout fields, and mobile-first layouts.

It’s the perfect setup for stores that care about speed, UX, and conversions.

2. PayPal: Best for Brand Trust & Flexible Payment Options

| Best For | Trusted, globally recognized, and wallet-based payments |

| Setup Fee | Free |

| Transaction Cost | |

| Ranking | A |

| Best Plugin | WooCommerce PayPal Payments |

PayPal is one of the most recognized and trusted online payment systems globally.

It gives your WooCommerce store instant credibility and allows shoppers to pay with PayPal balance, linked bank accounts, or credit/debit cards without needing to re-enter payment details.

It’s especially effective for international customers and people who already have a PayPal account and trust its buyer protection policies.

Standout features

- Quick funds credit option

- Professional invoicing tools

- Customizable API for developers

- Support for in-person payments via PayPal terminal

- Linked bank account transfers

- PayPal Credit financing

My experience

I’ve used the WooCommerce PayPal Payment plugin to integrate the PayPal gateway with WooCommerce, and it works like a charm.

It offers solid functionality, including support for PayPal Pay Later, subscriptions, and express checkout. But it does come with some quirks, especially around updates and compatibility with custom checkout flows.

It works flawlessly with FunnelKit’s high-converting checkouts.

However, if you use other checkout builders, make sure to test the PayPal method thoroughly. I found minor conflicts that needed tweaking (especially with embedded checkout layouts).

Still, PayPal is a must-enable option for every store I work on because many customers rely on it and feel more comfortable using it on their websites.

Pros

- Strong security and fraud protection

- Easy setup and user-friendly checkout

- Supports multiple payment methods (PayPal balance, cards, bank)

Cons

- The dispute resolution process may favor buyers

- Redirect-based checkout (can reduce conversions slightly)

- Limited checkout customization options

My verdict

PayPal is a must-have option for most WooCommerce stores, even if it’s not your primary gateway. Shoppers expect to see it, and many prefer it.

While the redirect checkout isn’t as seamless as Stripe, its reach and reputation make it a powerful addition to your payment stack.

Just be mindful of the fees and consider pairing it with a direct gateway plugin for flexibility.

3. Best for Native Payment Integration: WooCommerce Payments

| Best For | A fully integrated, beginner-friendly payment solution with support for subscriptions, wallets, and local methods |

| Setup Fee | Free |

| Transaction Cost | |

| Ranking | B |

WooCommerce Payments is the native payment solution built by WooCommerce that lets store owners manage transactions, track cash flow, and resolve disputes inside the WordPress dashboard.

Unlike third-party gateways, WooCommerce Payments offers seamless integration with your store, removing the need to juggle between external platforms.

Plus, it supports major payment methods like credit/debit cards, Apple Pay, Google Pay, and even local payment options such as Alipay.

Standout features

- Built into WordPress

- Subscriptions and recurring billing support

- Multiple payment methods

- Detailed analytics and reporting

My experience

I used WooCommerce Payments and found it to be a simple, beginner-friendly gateway.

The entire setup took less than 10 minutes. The native dashboard lets you view orders, handle refunds, and monitor deposits in the same interface.

While I initially hesitated due to country availability, WooCommerce Payments is rapidly expanding and has proved to be a lightweight, no-fuss option for handling all transactions without switching tabs or tools.

However, one thing to note: unlike Stripe, you can’t fully control payout schedules. This lack of flexibility can be limiting for stores with tighter cash flow requirements.

This is a WordPress version of Stripe. If you've a Stripe account, you can fully integrate it into WooCommerce, eliminating the need for this payment gateway.

Pros

- Seamless, native integration with WooCommerce

- Supports over 100 currencies and localized methods

- SCA-compliant with 3D Secure for strong fraud protection

Cons

- Limited country availability

- Payouts are on a fixed schedule (not customizable like Stripe)

- Funds take 1-2 days to deposit (unless you use Instant Payouts in the U.S.)

My verdict

WooCommerce Payments is a must-have for store owners looking for a tightly integrated, easy-to-use, and secure payment gateway, especially those already deep into the WooCommerce ecosystem.

If it’s available in your country, it’s one of the simplest and most efficient ways to accept online payments.

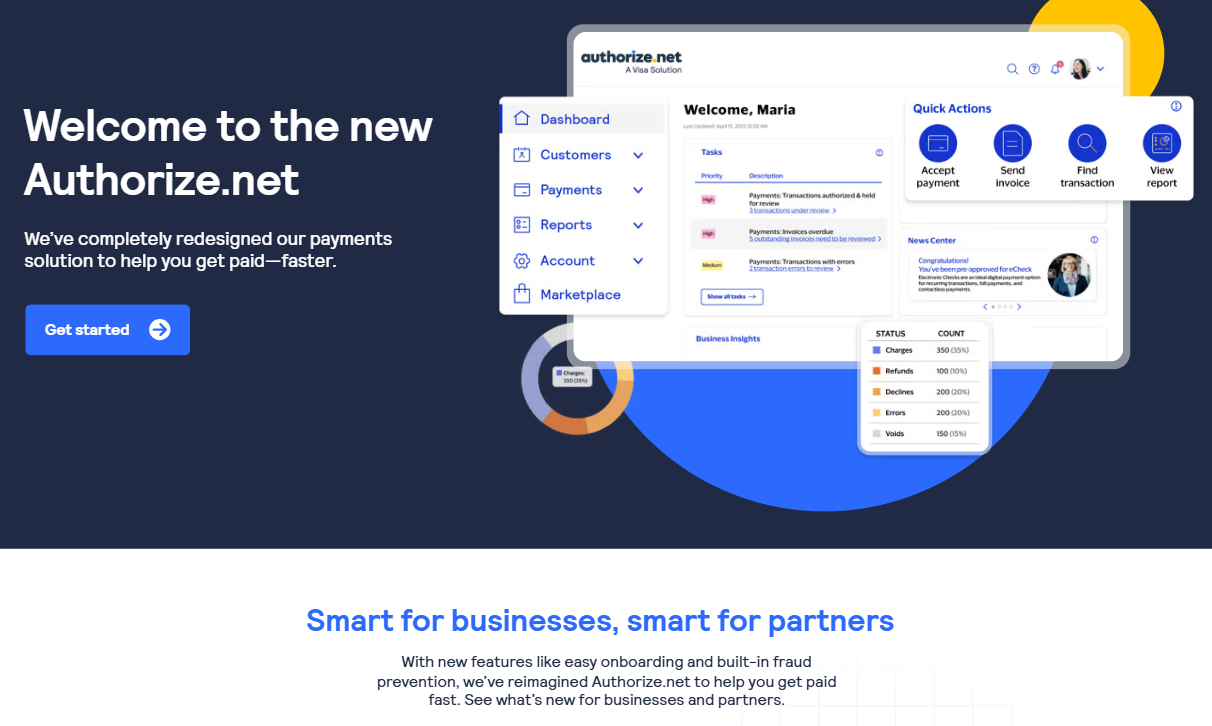

4. Authorize.net: Best for Recurring Payments & Fraud Protection

| Best For | Established small to medium-sized high-risk merchants who need advanced fraud protection, recurring billing, and multi-channel payment support |

| Setup Fee | $25/month |

| Transaction Cost | |

| Ranking | B |

| Best Plugin | Authorize.net Solution for WooCommerce |

Authorize.net is a well-established and trusted payment gateway known for its robust security, advanced features, and flexible payment processing options.

Owned by Visa, it’s a great choice for businesses that need reliable fraud protection, recurring billing, and multi-channel payment support (online, in-person, and mobile).

Standout features

- Advanced fraud detection suite (AFDS)

- Recurring payments support

- Wide payment acceptance

- Acceptance of major payment methods

- Quick fund deposits

- Secure payment forms

My experience

I integrated Authorize.net using this WordPress plugin from SkyVerge. While the setup was more involved than Stripe and PayPal, the results were worth it.

The overall system was flexible, reliable, and built for scale.

If your WooCommerce store handles complex billing or sells both online and in-person, Authorize.net is a rock-solid option.

It’s better suited for more established businesses that need advanced features and can handle a slightly more technical setup.

Pros

- Supports various payment methods

- PCI DSS compliant with strong security controls

- 24/7 customer support

Cons

- Monthly fees plus charges for each transaction

- Slightly complex onboarding setup for beginners

- Limited to merchants in the U.S., Canada, Australia, the U.K., and Europe

My verdict

Authorize.net can be your choice if you’re looking for a solid, secure, and feature-rich payment gateway.

I used it for a client with complex billing needs and high fraud risk.

It’s not for everyone, especially if you’re just starting out or running a low-volume store.

5. Best for Unified Online and In-Person Selling: Square

| Best For | Businesses and entrepreneurs who run physical stores, pop-up shops, or local service-based businesses. |

| Setup Fee | Free |

| Transaction Cost | |

| Ranking | A |

| Best Plugin | Square for WooCommerce |

Square is a popular payment gateway in WooCommerce known for its simplicity, transparency, and built-in POS system.

Its seamless integration with WooCommerce makes it a top choice for store owners to accept payments for products and services they provide.

Standout features

- In-person and online payment support

- Inventory management and invoicing tools

- PCI compliance with end-to-end encryption

- Built-in support for coupons, appointments, and Instagram integration

My experience

I tried Square for a client who runs a boutique store on WooCommerce.

The setup was quick using the official plugin, and syncing inventory was seamless, with no more overselling or stock confusion.

We were able to create invoices and send them right from the dashboard. Plus, it’s easy to offer local pickup and delivery options, too.

Its dashboard is user-friendly, and you don’t need to be tech-savvy to navigate it.

Pros

- Supports in-store pickup and local delivery options

- Real-time sales reporting

- Easy setup with transparent pricing

Cons

- Limited to a few countries (U.S., Canada, Australia, Japan, U.K., etc.)

- Customer support may be slow during peak hours

- Chargeback dispute resolutions take time

My verdict

Square is best suited for hybrid businesses that have physical and online stores.

If your business model includes pop-up shops, local markets, or a brick-and-mortar store alongside WooCommerce, Square offers unmatched convenience.

But if you're a purely digital brand, you might be better off with Stripe or PayPal for their advanced ecommerce capabilities.

6. Amazon Pay: Best for Fast Checkouts Using Saved Amazon Details

| Best For | Stores with returning customers or those selling to an Amazon-familiar audience. Especially effective for mobile-first shopping experiences. |

| Setup Fee | Free |

| Transaction Cost | |

| Ranking | B |

| Best Plugin | Amazon Pay for WooCommerce |

Amazon Pay allows customers to purchase items using the payment and shipping information stored in their Amazon accounts, making the checkout process smoother and faster.

It’s a powerful option if you want to reduce friction, especially for mobile shoppers or returning buyers who are already familiar with Amazon’s interface.

Standout features

- Seamless integration with Amazon’s interface

- Multi-currency support

- Secure storage and encrypted transaction processing

- Automatic decline handling to keep the checkout flow smooth when payments fail

- Designed for nonprofits, small businesses, and enterprises alike

My experience

I used Amazon Pay for WooCommerce to implement the payment for a high-volume store selling home decor and lifestyle products.

The initial setup was straightforward and everything worked smoothly.

However, its limitation is the UI flexibility. You’re expected to use Amazon-branded buttons and flows, which may compromise the overall design aesthetic.

Pros

- Optimized for mobile apps

- Supports multiple currencies

- Faster checkout with the express Amazon Pay method

Cons

- Only usable by customers who have an Amazon account

- Higher fees for cross-border transactions

- Does not support chargeback dispute resolutions

My verdict

Amazon Pay is a powerful payment gateway if you're looking to capitalize on brand familiarity and build immediate trust with your customers.

Its one-time checkout experience is polished and secure.

If your store caters to a broad consumer base and you want to simplify payments without adding extra monthly costs, Amazon Pay is definitely worth considering.

7. Best for Enterprise-Level Global Payments: Adyen

| Best For | Global businesses looking for an enterprise-grade payment platform with support for multiple payment methods, currencies, and risk management tools. |

| Setup Fee | Free |

| Transaction Cost | |

| Ranking | B |

| Best Plugin | Adyen for WooCommerce |

Adyen is a powerful, all-in-one payment solution trusted by major global brands like Uber, Spotify, and eBay.

It enables WooCommerce stores to accept payments in 150+ currencies and through a wide variety of methods, including credit cards, digital wallets, and even local methods like iDEAL or Bancontact.

Its strength lies in its enterprise-grade infrastructure and global scalability, making it ideal for large or fast-growing WooCommerce stores.

Standout features

- Built-in risk management and fraud prevention (RevenueProtect)

- 3D Secure, fraud detection, and risk management

- Unified reporting and financial reconciliation across channels

- Transparent, customized pricing for high-volume businesses

My experience

I tested Adyen on a WooCommerce store with international customers and saw impressive results.

The checkout process was smooth, and real-time fraud prevention successfully blocked several suspicious transactions without impacting legitimate users.

However, the initial setup and approval process took time, and some smaller merchants might find the onboarding less straightforward.

Pros

- Perfect for scaling across multiple countries

- Advanced fraud prevention features with machine learning

- Powerful developer-friendly APIs

Cons

- Complex setup for smaller merchants

- Not ideal for low-volume WooCommerce stores

My verdict

Choose Adyen if you need enterprise-grade reliability, global reach, and advanced fraud protection.

But if you’re looking for something simpler and more plug-and-play, a gateway like WooCommerce Payments or Stripe might be more suitable.

Geographic Coverage: Top Payment Gateways by Country

Many countries have their own preferred payment methods.

While gateways like Stripe and PayPal offer global reach, localized solutions often boost trust and conversions.

Here are the top WooCommerce payment gateways by country:

| Top payment gateway in the United States | Stripe and PayPal |

| Best payment gateway in Germany | Klarna and PayPal |

| Top payment gateway in India | Razorpay and Cashfree |

| Top payment gateway in France | Stripe, PayPal, and Klarna |

| Best payment gateway in the Netherlands | Mollie and Stripe |

| Top payment gateway in the United Kingdom | Stripe and PayPal |

| Best payment gateway in Brazil | PagSeguro and Mercado Pago |

| Top payment gateway in Israel | 2Checkout (now Verifone) |

| Best payment gateway in Singapore | Airwallex |

| Top payment gateway in the UAE | PayTabs and Telr |

| Best payment gateway in Canada | Stripe and PayPal |

| Top payment gateway in Poland | BLIK and Przelewy24 |

Frequently Asked Questions (FAQs)

1. What is the best payment gateway for a small WooCommerce store?

If you're running a small store, WooCommerce Payments or PayPal is a great place to start. They're easy to set up, widely trusted, and integrate seamlessly with WooCommerce.

For stores that also sell in-person, Square is an excellent choice.

2. Can I use multiple payment gateways on the same WooCommerce store?

Yes, WooCommerce allows you to use multiple payment gateways simultaneously. For example, you can set up Stripe and PayPal in your store.

This flexibility enables your customers to choose their preferred payment method, increasing conversion rates and reducing cart abandonment.

3. What are the most suitable gateways for mobile-first stores?

Stripe, Apple Pay, Google Pay, and Amazon Pay offer mobile-optimized checkout experiences.

They support one-tap payments, autofill, and secure authentication, making these gateways perfect for mobile-first stores.

4. Can I offer multiple currencies for international customers?

Absolutely. Gateways like Stripe, PayPal, Adyen, and Braintree support multi-currency transactions.

Pairing them with a multi-currency plugin for WooCommerce ensures customers can browse and pay in their local currency.

5. How do I resolve payment errors or disputes in WooCommerce?

Most top gateways like Stripe, PayPal, and Authorize.net have built-in dispute resolution centers.

You can also monitor transactions and issue refunds directly from your WooCommerce dashboard if your gateway is tightly integrated (e.g., WooCommerce Payments or Stripe).

Make sure to enable email notifications for payment issues and consider adding trust badges to reduce the chance of disputes.

Wrapping Up: Choose the Right WooCommerce Payment Gateway for Your Store

There’s no one-size-fits-all solution when it comes to WooCommerce payment gateways.

The right choice depends on your business model, target market, currencies, and the kind of checkout experience you want to offer.

That’s why I always prefer gateways with:

- Low transaction fees and transparent pricing

- Support for credit/debit cards, wallets, BNPL, and local payments

- Coverage across your target countries and currencies

- Strong fraud protection and PCI compliance

- Easy integration with reliable support

Over the years, I’ve tested countless gateways from local setups to global solutions for WooCommerce projects of all sizes.

I’ve learned that even the best payment gateway can’t fix a poor checkout experience.

A smooth, secure, and conversion-optimized checkout is just as important as your gateway choice.

That’s why I always recommend pairing a good payment processor with a high-performing checkout design.

Personally, I use FunnelKit to build WooCommerce checkouts that load faster, look better, and convert higher.

From trust badges and easy checkout fields to real-time validation and dynamic upsells, FunnelKit makes it all possible without writing a single line of code.

Give it a try and upgrade your WooCommerce checkout experience today!

Bonus guides for an effective checkout page:

- Best WooCommerce checkout plugins

- Customize the WooCommerce checkout page

- Optimize WooCommerce checkout for higher conversions

- Set up abandoned cart recovery to bring back lost revenues

Thanks for reading! Stay connected with us on the Facebook group, X (Twitter), Instagram, and YouTube channel for more tips to help grow your business.

Editorial Team

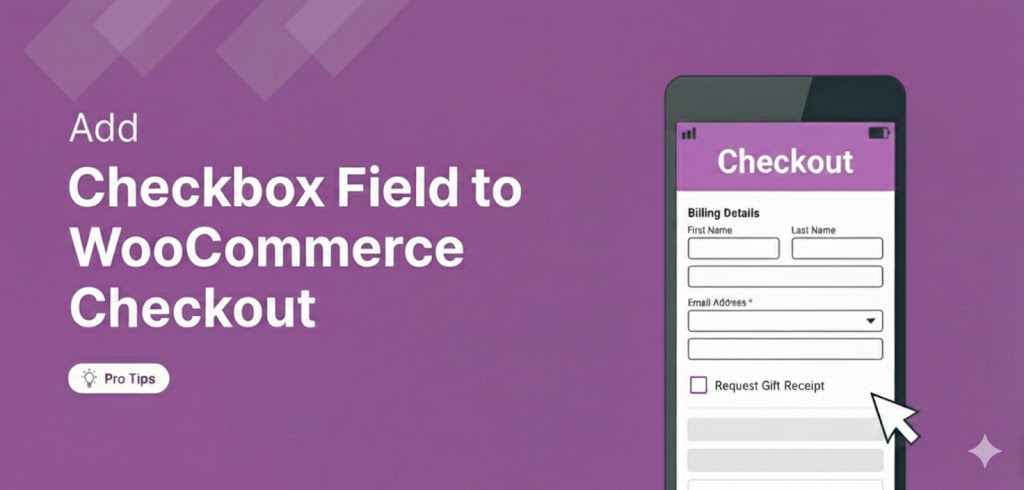

February 4, 2026Adding a checkbox to the WooCommerce checkout is one of the easiest ways to collect information from customers, without asking them to do much extra. Think about it. The customer...

Editorial Team

February 3, 2026Ever wondered why some physical product stores easily turn visitors into customers while others struggle? Your product’s solid, and your marketing’s sharp, but conversions stay low. Why? Because typical website...

Editorial Team

January 26, 2026Customers reach the checkout and hit that all-important place order button, yet the order fails. It’s frustrating, right? Failed orders can hurt both revenue and customer experience, but you can...