Do you want to set up WooCommerce Buy Now Pay Later (BNPL) payment options in your store?

As a WooCommerce store owner, providing flexible payment options is crucial to staying competitive in today’s eCommerce marketplace.

This is where Buy Now Pay Later (BNPL) payment plans come into play.

You can seamlessly integrate BNPL into your WooCommerce business and offer your customers the opportunity to pay less upfront for your products. This is especially useful when they have a tight budget, while it also drives sales in your store.

Buy now pay later (BNPL) accounted for 5% of global eCommerce transaction volume in 2022 and is expected to grow at a CAGR of 16% between 2022 and 2026. [FIS Global Payments Report 2023]

You can easily utilize the popularity of this BPNL payment method and integrate it with WooCommerce to grow sales of your online store.

In this post, we’ll help you understand everything about the buy now, pay later payment method and how to enable it in WooCommerce.

Here's a quick video tutorial on setting up buy now pay later methods in WooCommerce:

Setting up BNPL options won't make sense if you don't have high-converting elements on your checkout page - Click here to create an optimize buying flow and grow your business!

Contents

Buy Now Pay Later is a payment method that lets customers make purchases and pay for them over time, typically in installments.

With BNPL, customers can buy products and services immediately, even when they are under budget constraints and spread out the cost into smaller, more manageable payments.

For example, a user can buy a product worth $100 by paying $25 in installments for 4 months.

This allows customers to afford the things they want with easily manageable installments.

It’s highly popular among shoppers. As per Juniper Research, an estimated 360 million people use BNPL globally. It’s expected that there will be 900 million BNPL users by 2027 (an increase of 157%).

Buy now pay later is an alternative to traditional credit cards; however, it typically involves minimal to no interest, based on the shopper’s credit. At the same time, credit cards levy too much interest on payment plans.

You can easily integrate BNPL payment gateways into WooCommerce to increase conversions, generate more sales and foster customer loyalty.

That’s why there are now 200+ global providers that offer installment loans.

Some popular BNPL payment gateways include Afterpay, Affirm, Klarna, PayPal Credit, Perpay, Zip, and Sezzle.

Let's now understand how these BNPL payment gateways work.

Buy Now, Pay Later is the fastest-growing eCommerce payment method and is projected to reach $3.7 trillion by 2030.

Integrating the BNPL payment gateway with WooCommerce can revolutionize your business.

Here’s a quick breakdown of how WooCommerce buy now pay later works:

Step 1: Integration with BNPL operators - Integrate WooCommerce with BNPL service providers such as Afterpay, Affirm, Klarna, etc. You can easily do it with different plugins (which we’ve listed below in this post).

Step 2: Checkout process - When a customer adds items to their cart and proceeds to checkout, they are provided with an option to choose a BNPL payment plan.

Step 3: Selection of BNPL payment option - To opt for a buy now pay later payment scheme, customers need to select this payment option on the WooCommerce checkout page.

Step 4: Purchase approval - The BNPL provider will direct shoppers to a quick assessment of their creditworthiness or eligibility based on different factors such as credit history, transaction amount, eligible items, etc. Once approved, shoppers can proceed with the purchase.

Step 5: Payment schedule - Instead of paying the full amount upfront, shoppers can select a payment plan over a set period. The interest on these payment plans varies as per the shopper’s credit (interests usually vary from 0% to 36% APR). After selecting a plan, the process moves to the payment processing stage.

Step 6: Payment processing - The BNPL provider handles the processing and collection of the payment from the customer based on the agreed-upon schedule.

Step 7: Merchant receives the payment - Once the transaction is complete, the WooCommerce merchant receives the complete payment for the purchase from the BNPL operator. The merchant receives the full amount upfront, and the BNPL provider goes through the risk of collecting payments from the customer over time.

While BNPL services offer convenience and flexibility for consumers, it’s crucial to be mindful of the potential costs involved, such as interest rates.

Once you have all the numbers, it’s best to make an informed decision.

Offering Buy Now, Pay Later (BNPL) options in your WooCommerce store can benefit both merchants and customers.

With BNPL, store owners can generate more sales and foster customer loyalty, encouraging repeat purchases. Additionally, customers enjoy the flexibility and convenience of making purchases without worrying about their budgets.

Here are some of the popular Buy Now, Pay Later payment gateways compatible with WooCommerce:

1. Klarna

Klarna is a Swedish fintech company founded in 2005 that provides flexible shopping experiences to 150 million active customers across 500,000+ merchants in 45 countries.

It allows payment options such as:

You can use Klarna in Sweden, Norway, the U.S.A., Switzerland, Denmark, Germany, Austria, and more.

2. Affirm

Affirm is the leading buy now pay later option in the U.S. with 17.6 million users and $20.2 billion GMV annually.

Here are the payment options that Affirm offers:

The Affirm payment method is currently available in the United States of America and Canada.

3. Afterpay

Afterpay (also known as Clearpay in the UK) is an Australian fintech company founded in 2014 that has more than 5 million active consumers across 15000+ merchants.

These are the payment options for Afterpay:

The Afterpay payment gateway is currently available in the United States of America, Australia, New Zealand, United Kingdom, and Canada.

4. PayPal Credit

Known as “Bill Me Later”, PayPal Credit offers a reusable credit line into your PayPal account that allows shoppers to finance purchases online and make payments over time.

PayPal Credit is available just about anywhere PayPal is accepted. It is available in 200 countries/regions and supports 25+ currencies.

Customers can pay 6 months of interest-free installments on any purchase over $99. However, interest will be charged to their account if they fail to pay the amount within 6 months from the date of purchase.

Follow this step-by-step guide to set up WooCommerce Buy Now Pay Later in your store.

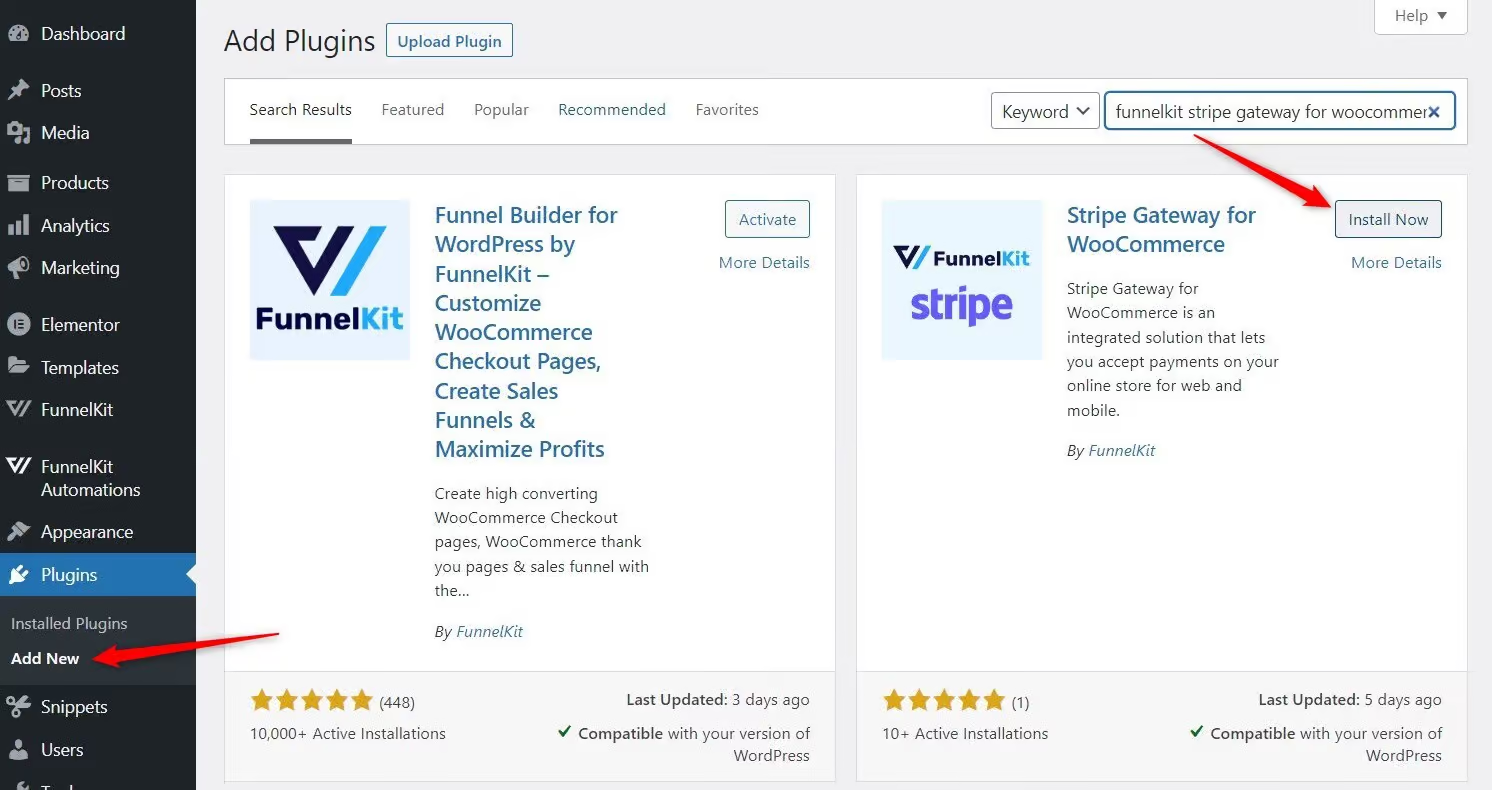

Navigate to Plugins ⇨ Add New Plugin on your WordPress dashboard and search for 'FunnelKit Stripe Gateway for WooCommerce'.

Install and activate the plugin as shown in the screenshot below:

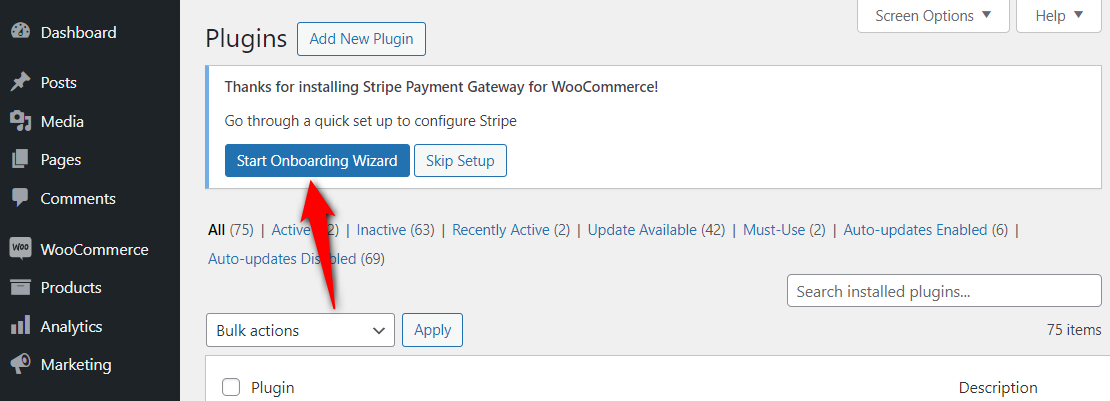

After installing the Stripe gateway plugin, click on the ‘Start Onboarding Wizard’ button.

It’ll direct you to the WooCommerce - Stripe connection process.

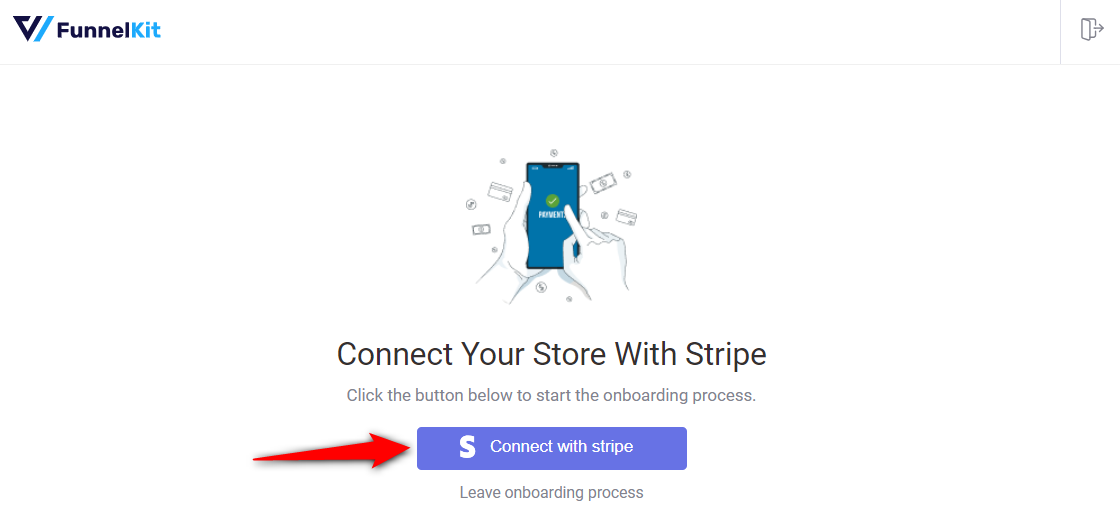

Here, hit the ‘Connect with Stripe’ button.

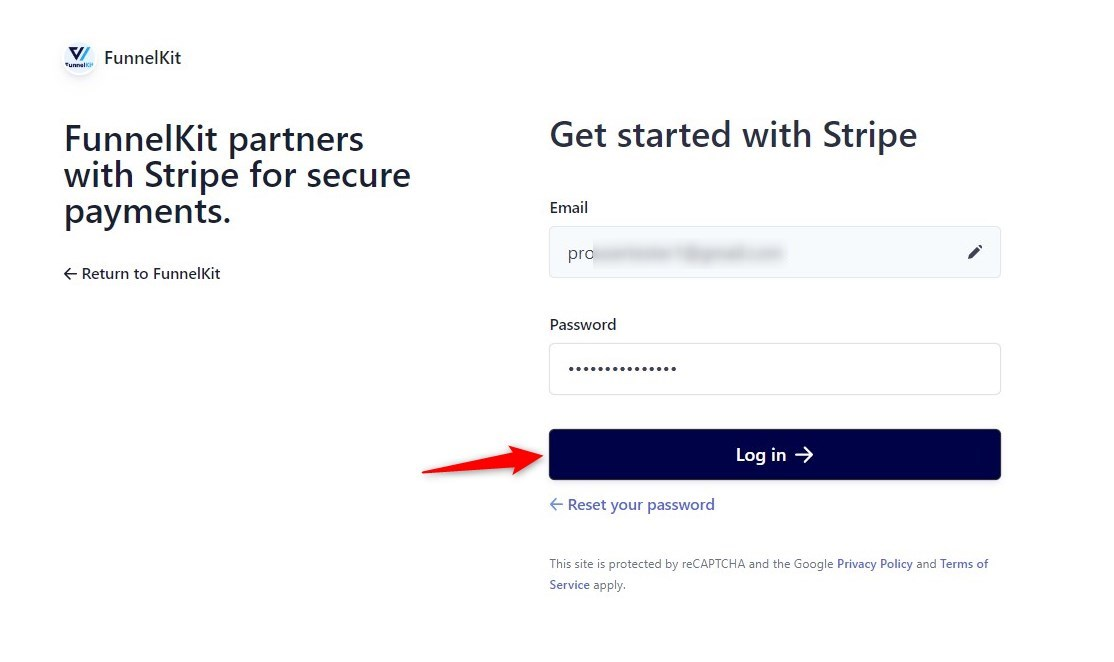

Sign in to your Stripe account with your login credentials, including your email address and password.

Verify your authorization by entering the 6-digit verification code sent to your registered phone number.

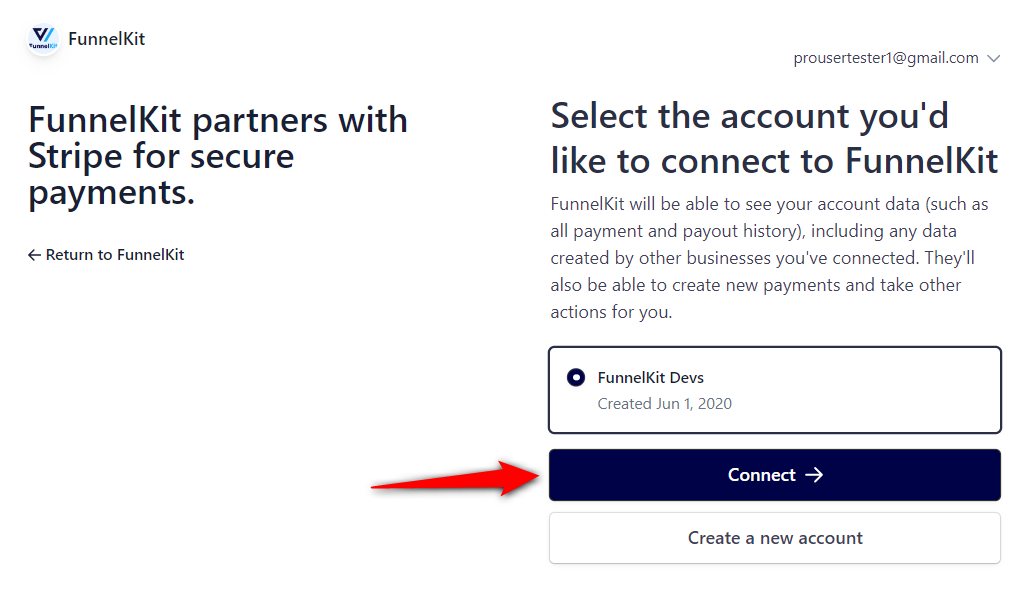

Confirm your Stripe account by selecting it and clicking on ‘Connect’.

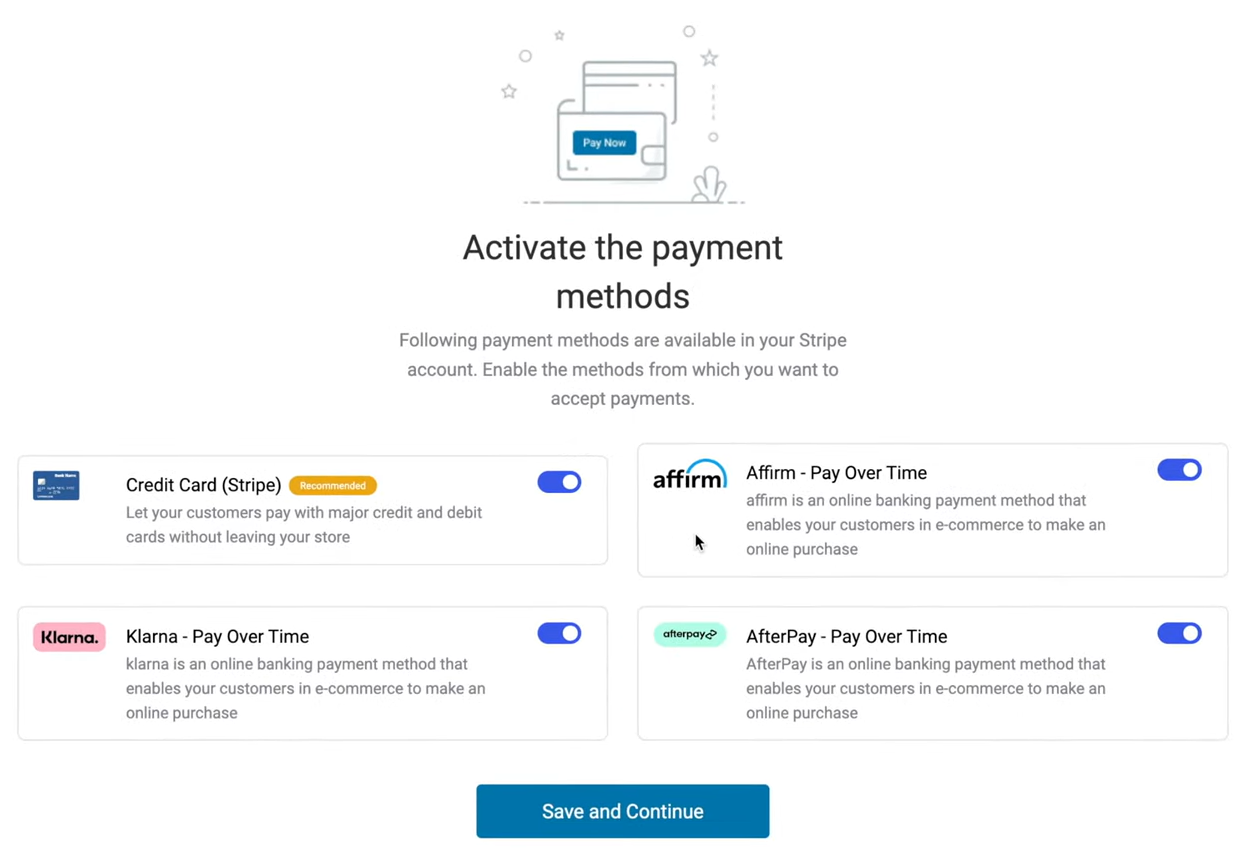

You’ll see different payment options on this screen.

Enable the Credit Card (Stripe) and any of your preferred WooCommerce Buy Now Pay Later payment gateways - Affirm, Klarna, or Afterpay.

Click on the ‘Save and Continue’ button.

🔔 Make sure to activate these BNPL gateways inside your Stripe dashboard.

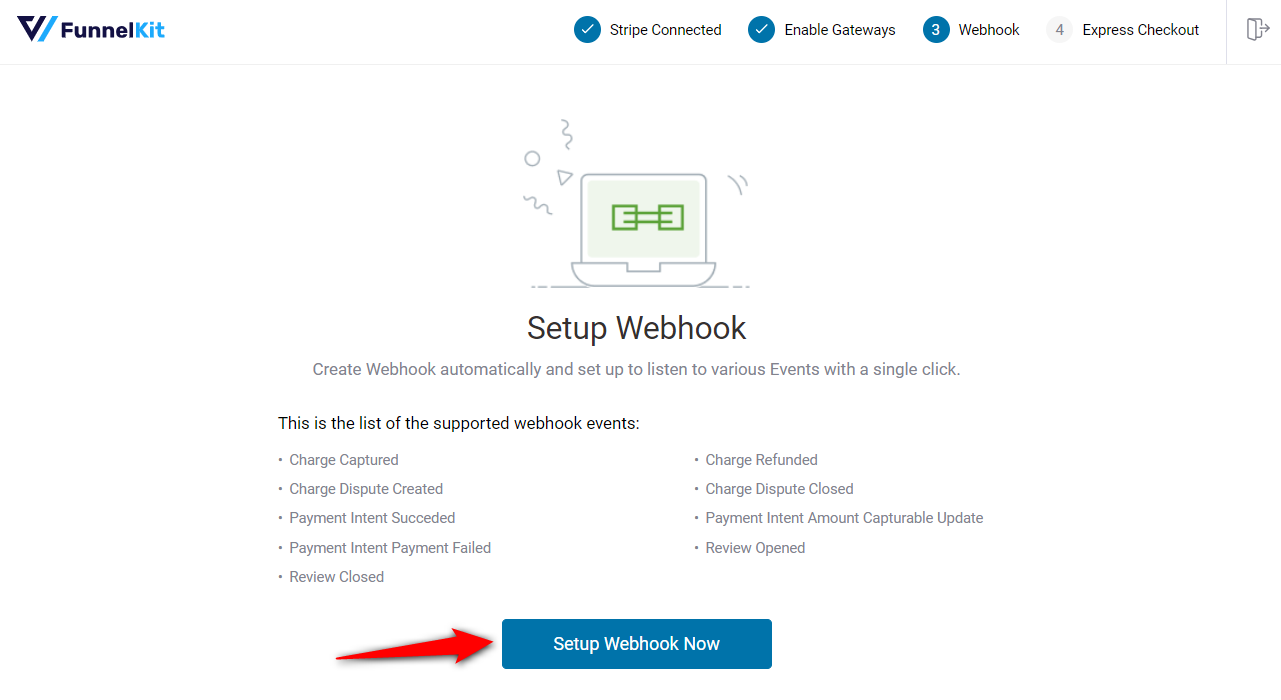

The Stripe gateway plugin automatically activates your webhooks to capture various events.

For that, hit ‘Setup Webhook Now’.

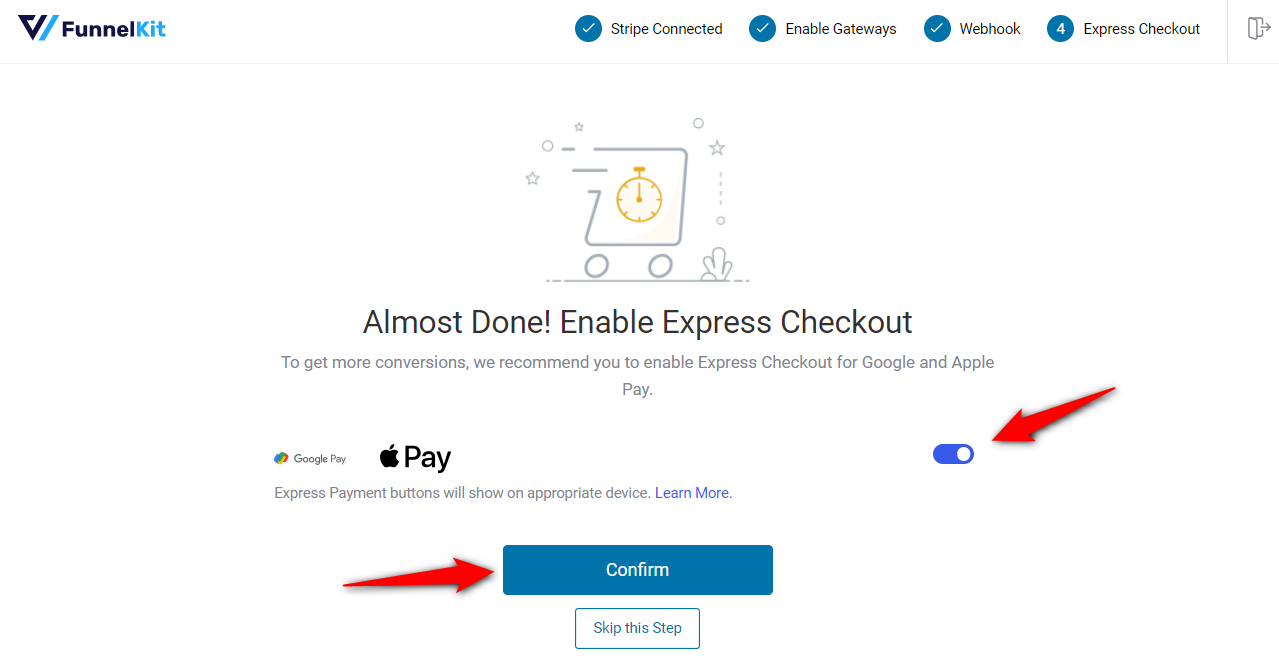

This option enables you to set up express checkout payments such as Google Pay and Apple Pay.

Turn the toggle to enable express checkout payments in your WooCommerce store.

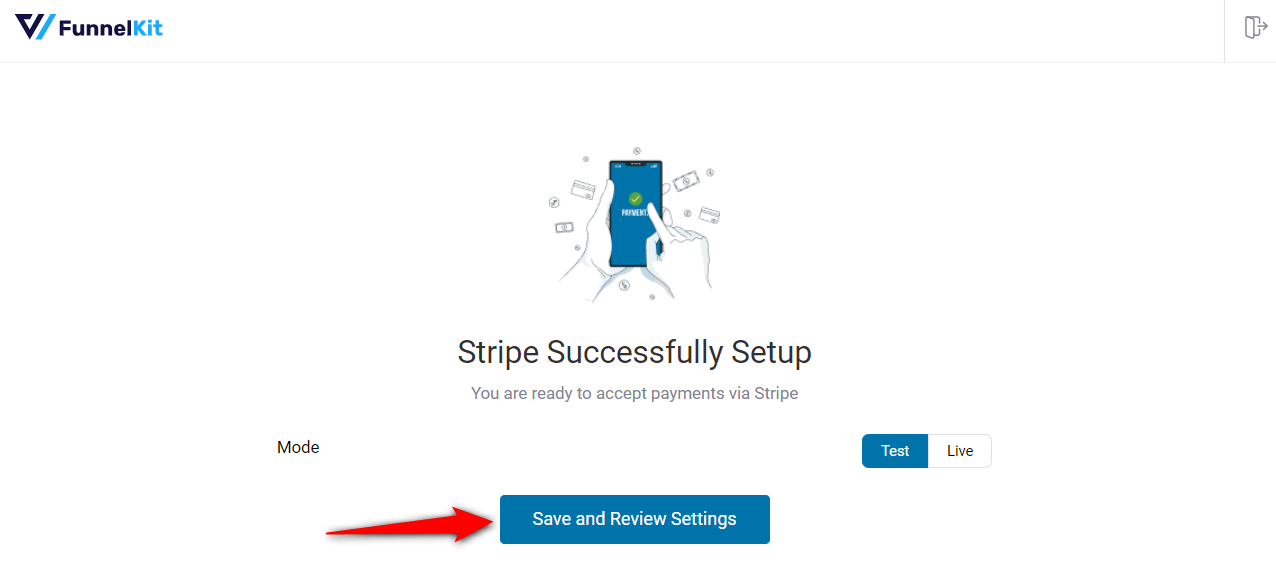

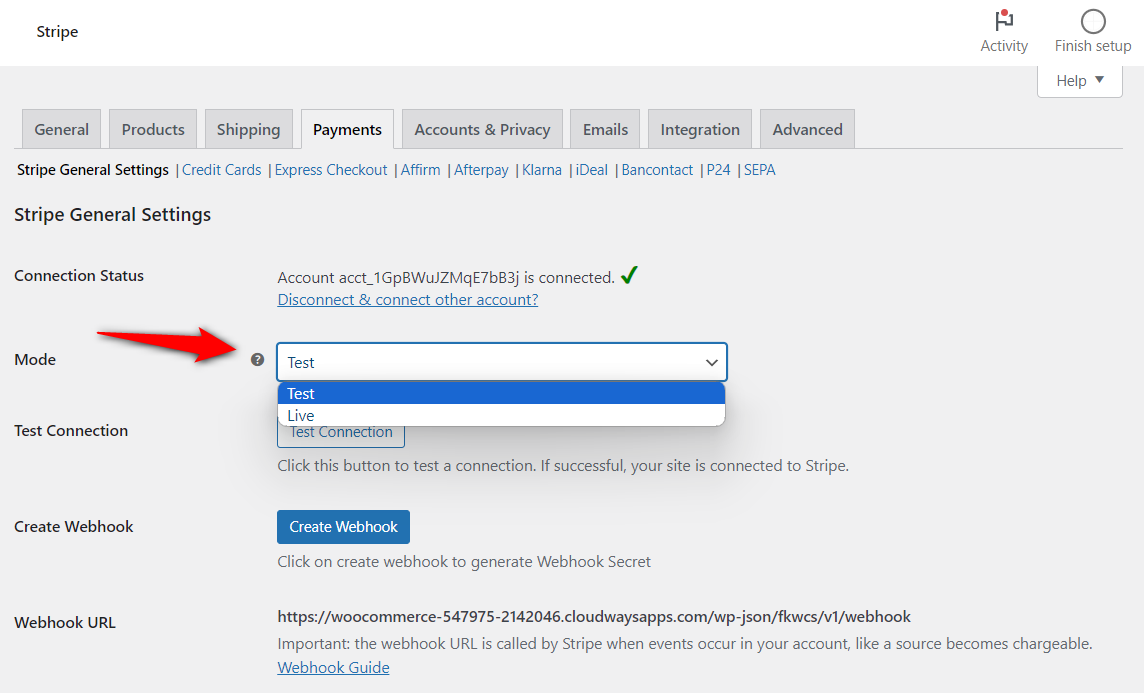

Confirm the live or test mode you want to run on your WooCommerce store.

For now, we recommend turning on the ‘Test’ mode and clicking on ‘Save and Review Settings’.

This will successfully connect your Stripe account with your WooCommerce store.

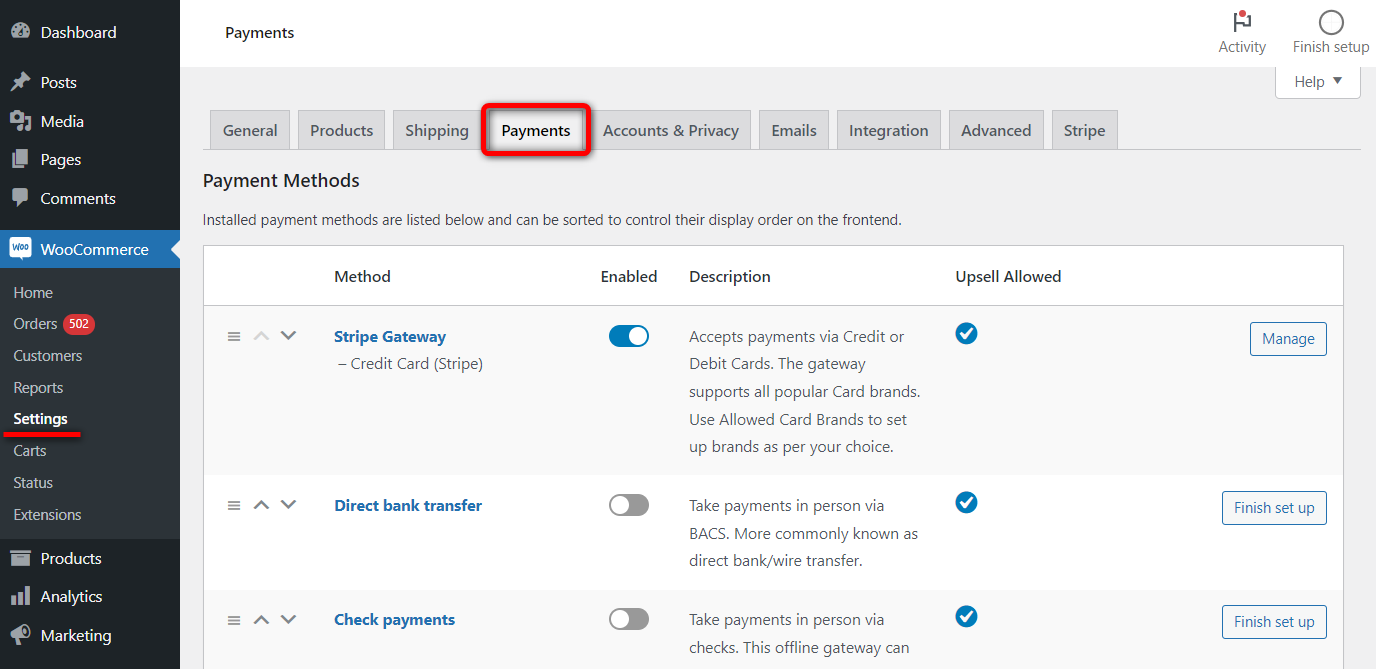

Navigate to the WooCommerce Settings ⇨ Payments section.

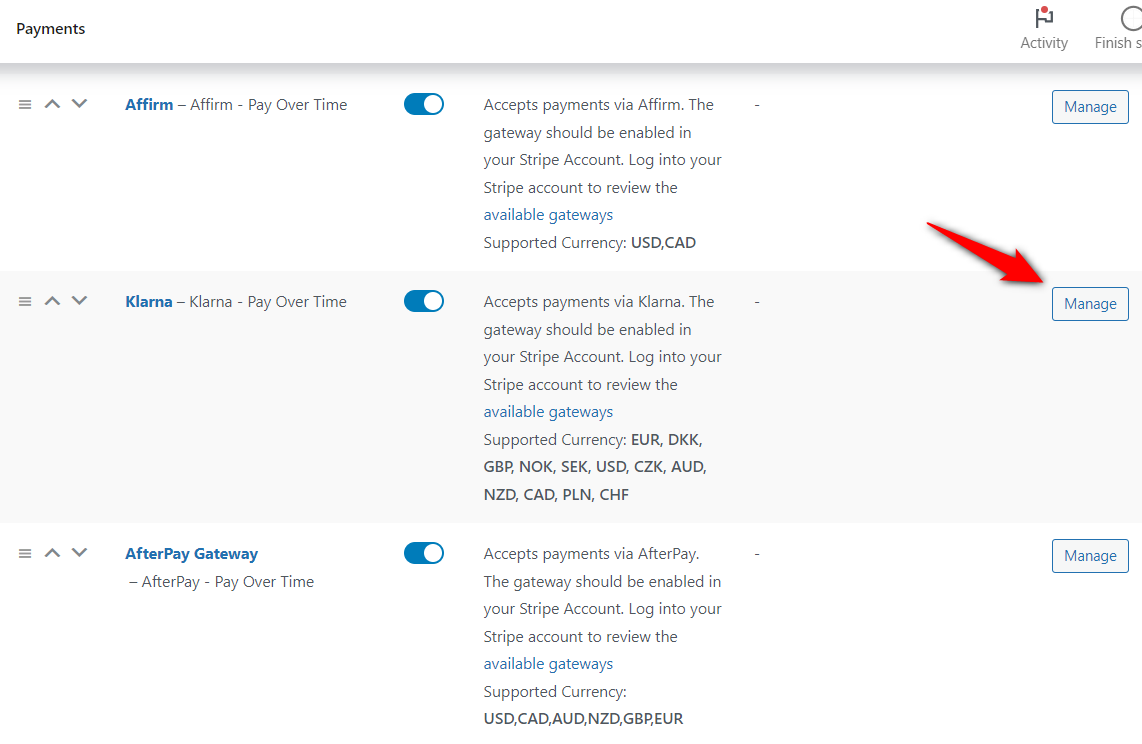

Scroll down to the section and you’ll find Affirm, Klarna and AfterPay.

Hit the ‘Manage’ button next to it.

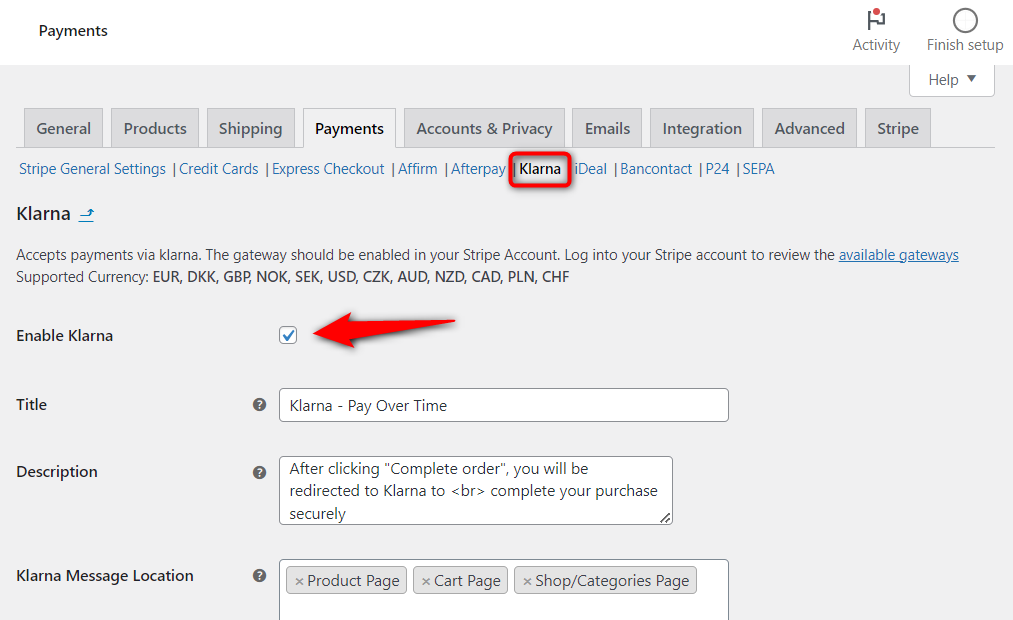

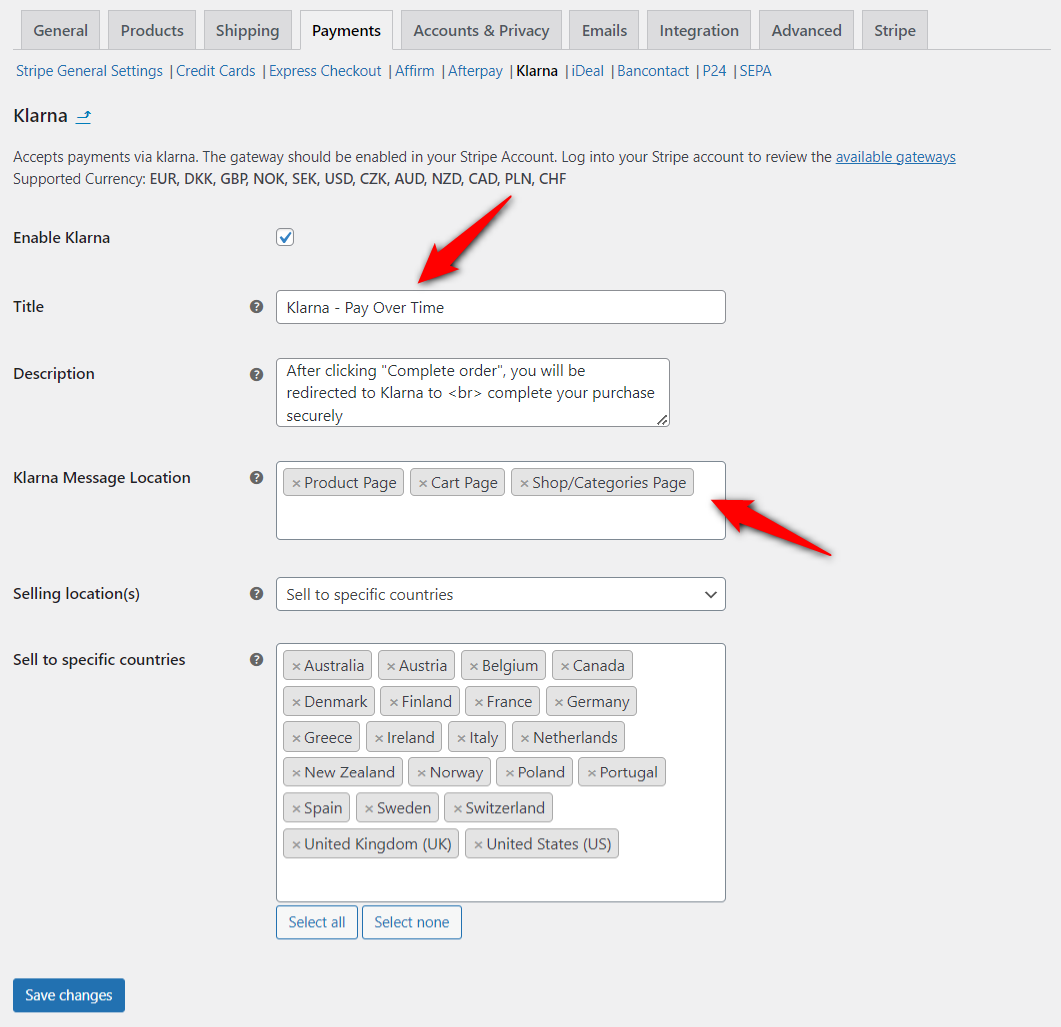

Next, check the option next to ‘Enable Klarna Payments’.

Please note that these options are the same for all the available WooCommerce BNPL payment gateways.

This will enable Klarna in your WooCommerce store.

Do the same for all Buy Now Pay Later payment options - Affirm, Afterpay and Klarna.

Configure your Klarna BNPL payment gateway from the following options:

This is how the Klarna payment message appears on the category page:

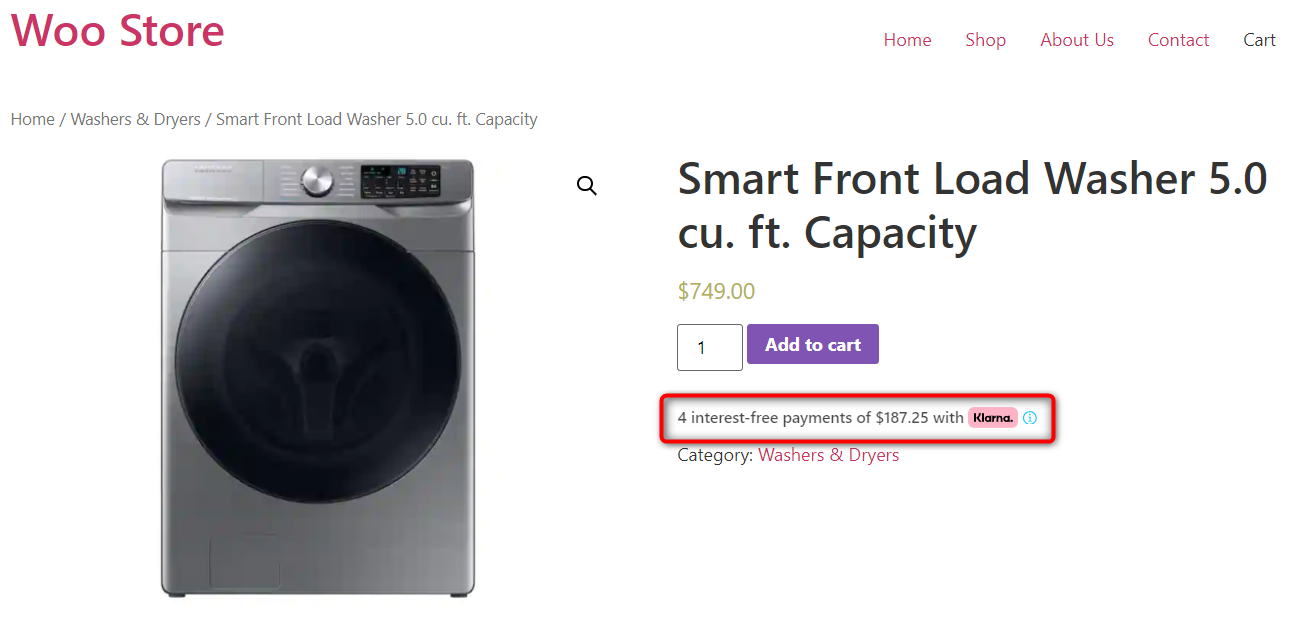

On the product’s page:

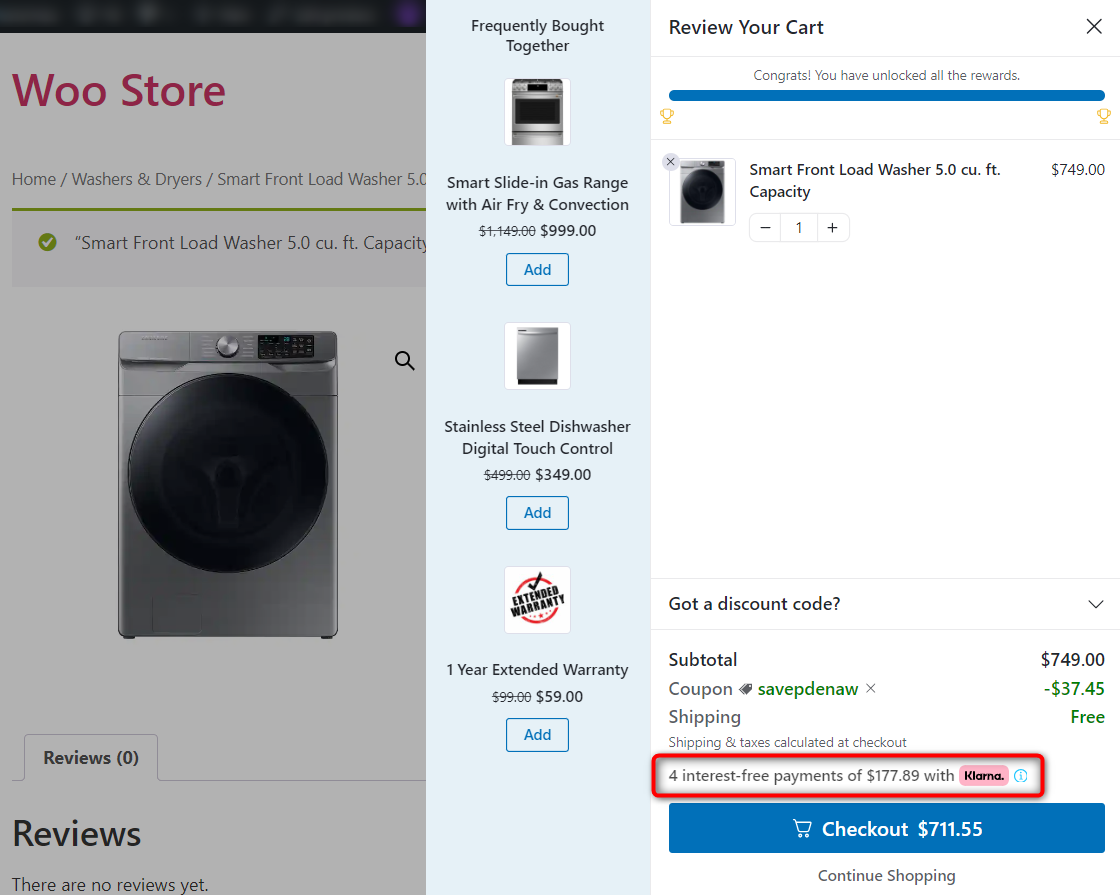

Inside the shopping cart:

You can skip the default redundant cart page and directly head to the checkout.

Witness the FunnelKit Cart’s sliding shopping cart, offer upsells inside the cart and provide cart discounts.

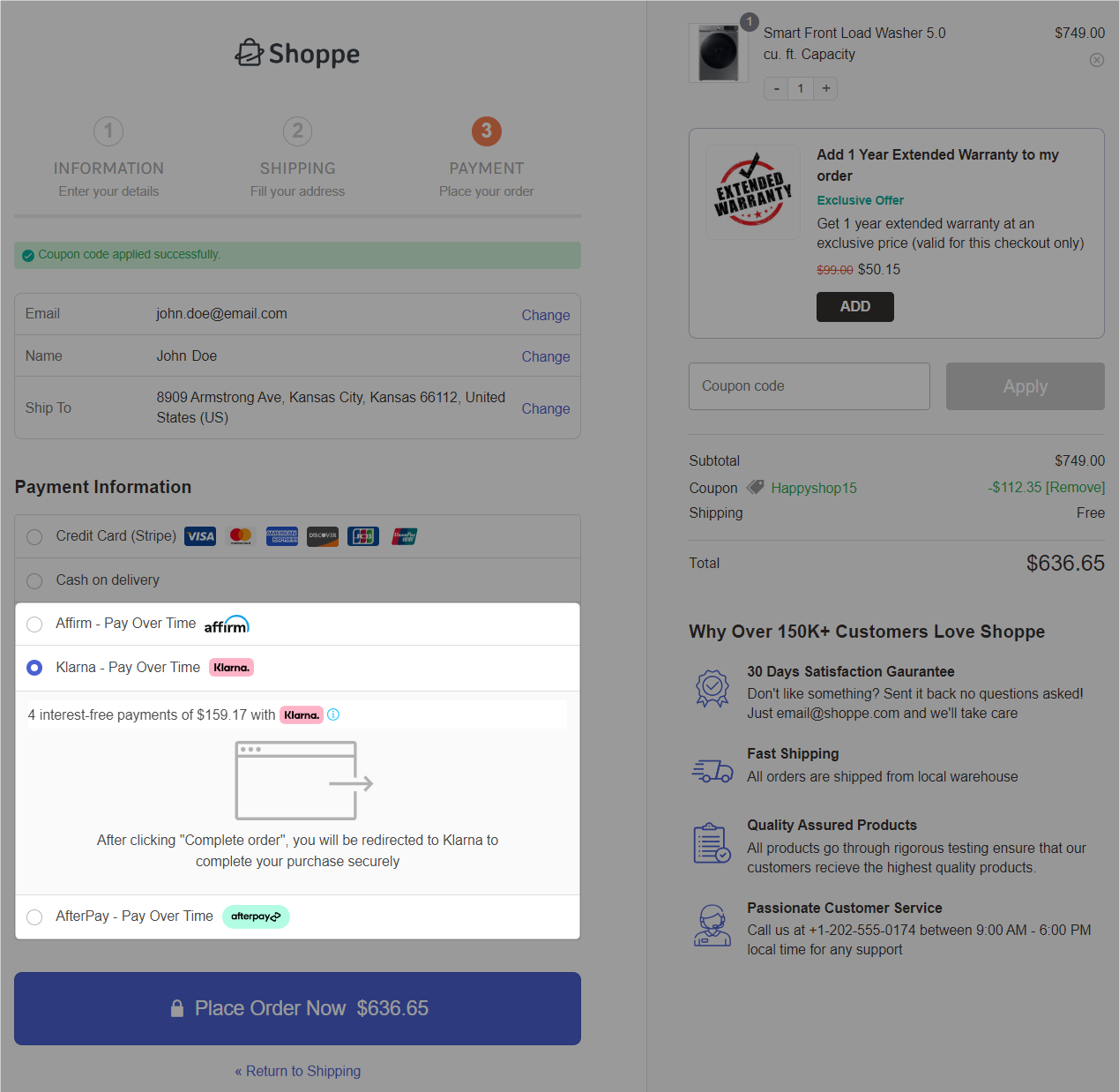

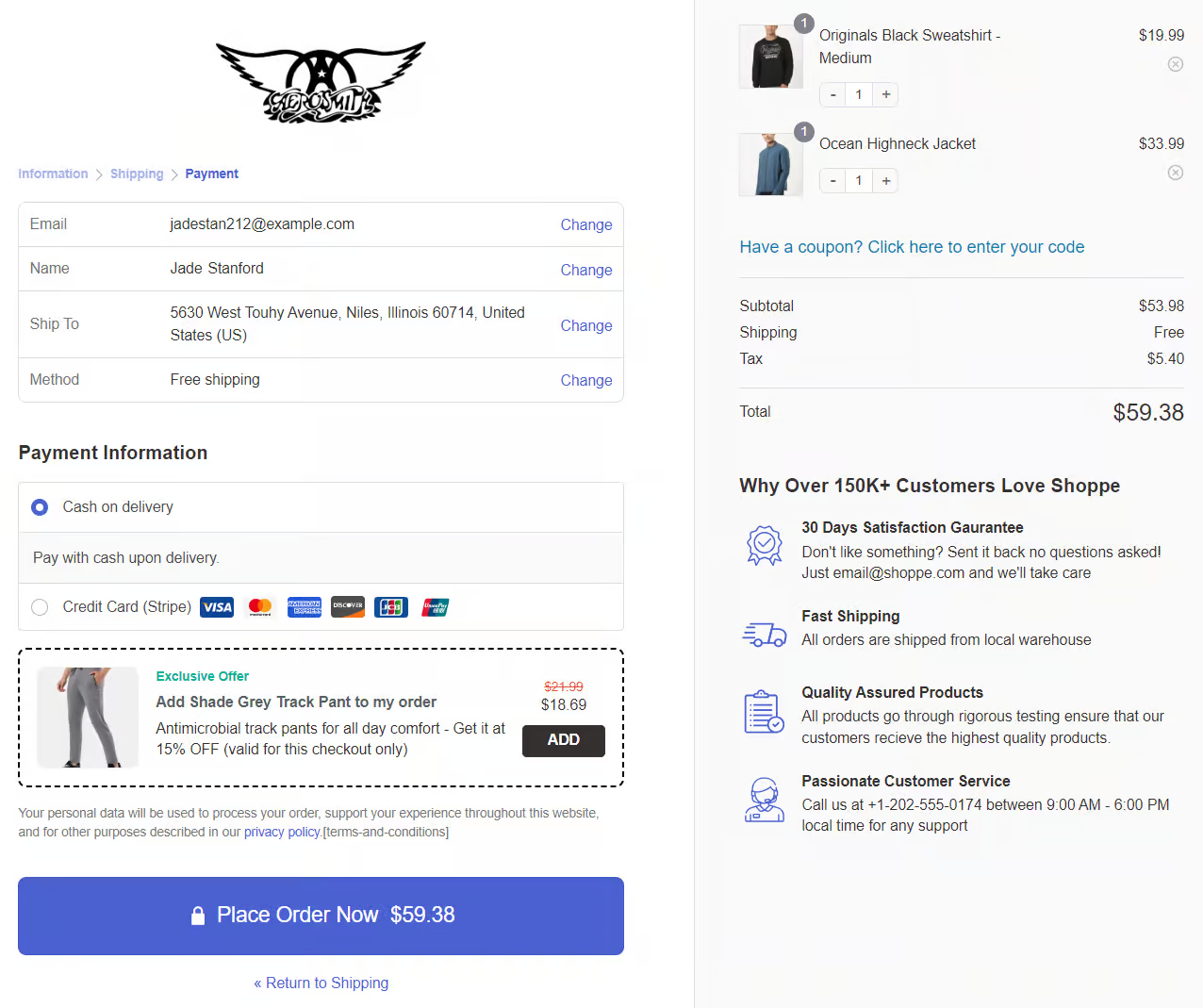

Scroll down below to see the Klarna payment method on the checkout page.

Put your website in the ‘Test’ mode from WooCommerce payment settings to test the Buy Now Pay Later payment method.

Now go to your store and add an item to your shopping cart and head over to the checkout page.

Click on any of the BNPL payment options and hit the place order button.

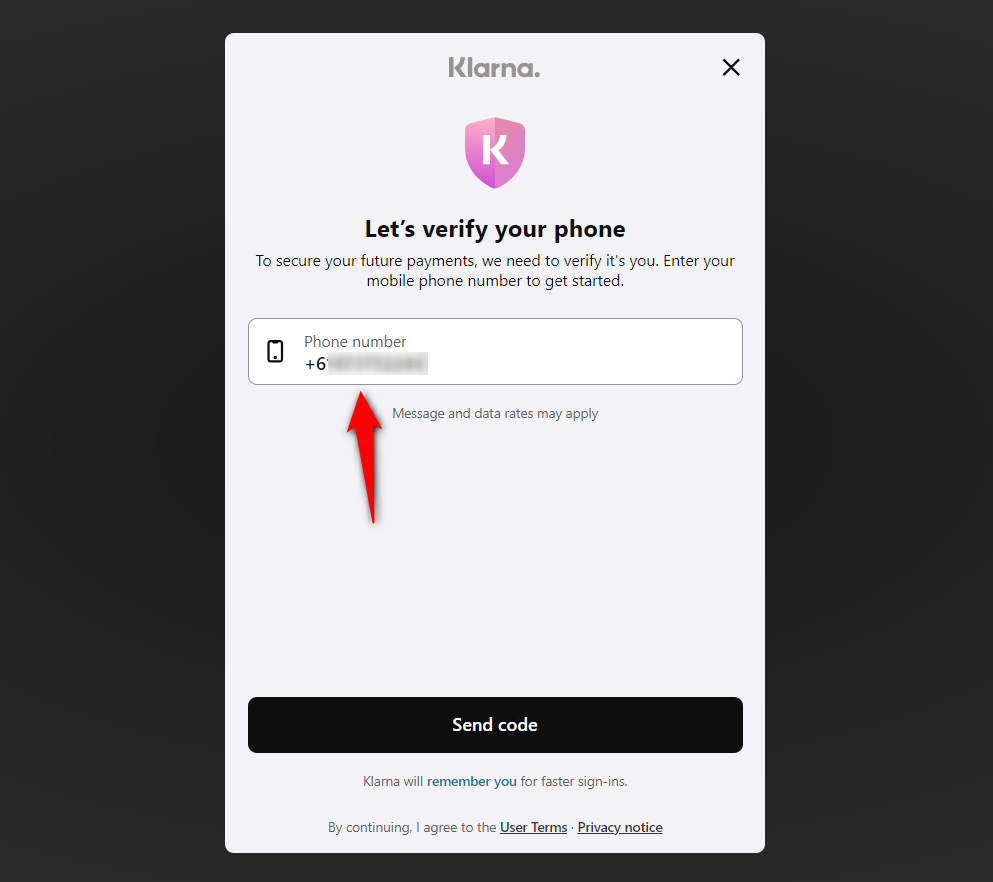

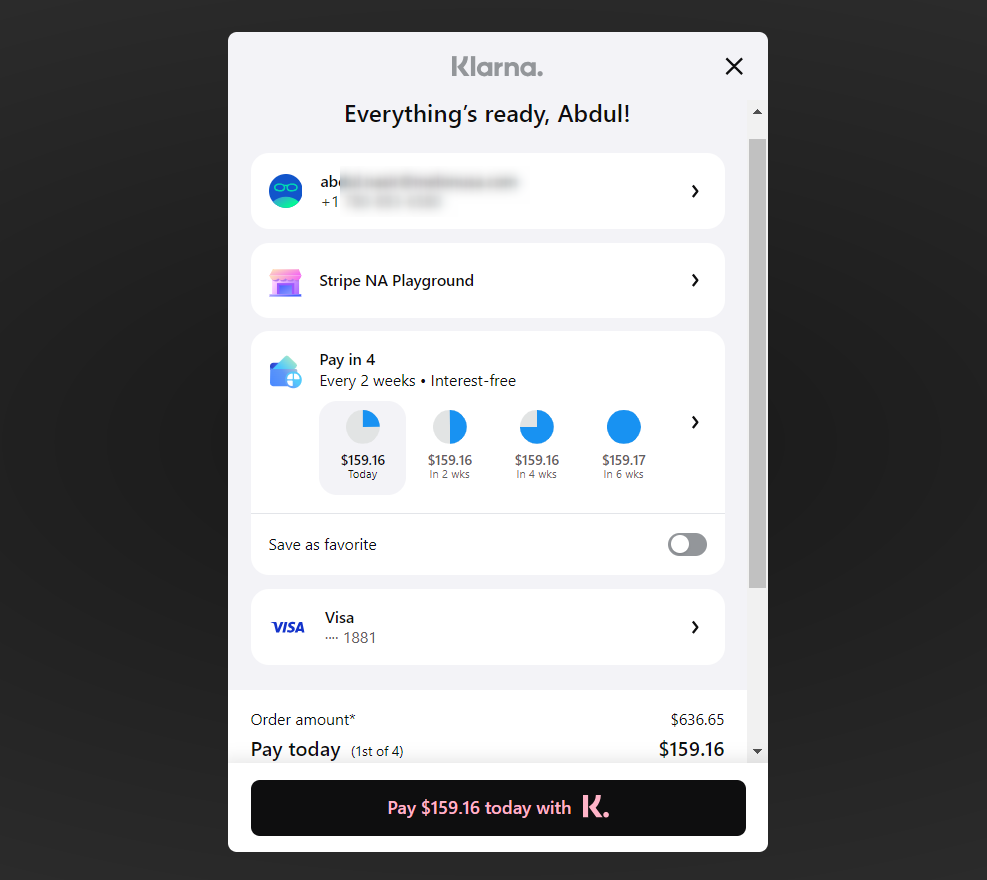

It’ll take you to a popup window to check your BNPL loan eligibility or purchasing power.

Enter your phone number and verify it by entering the 6-digit verification code.

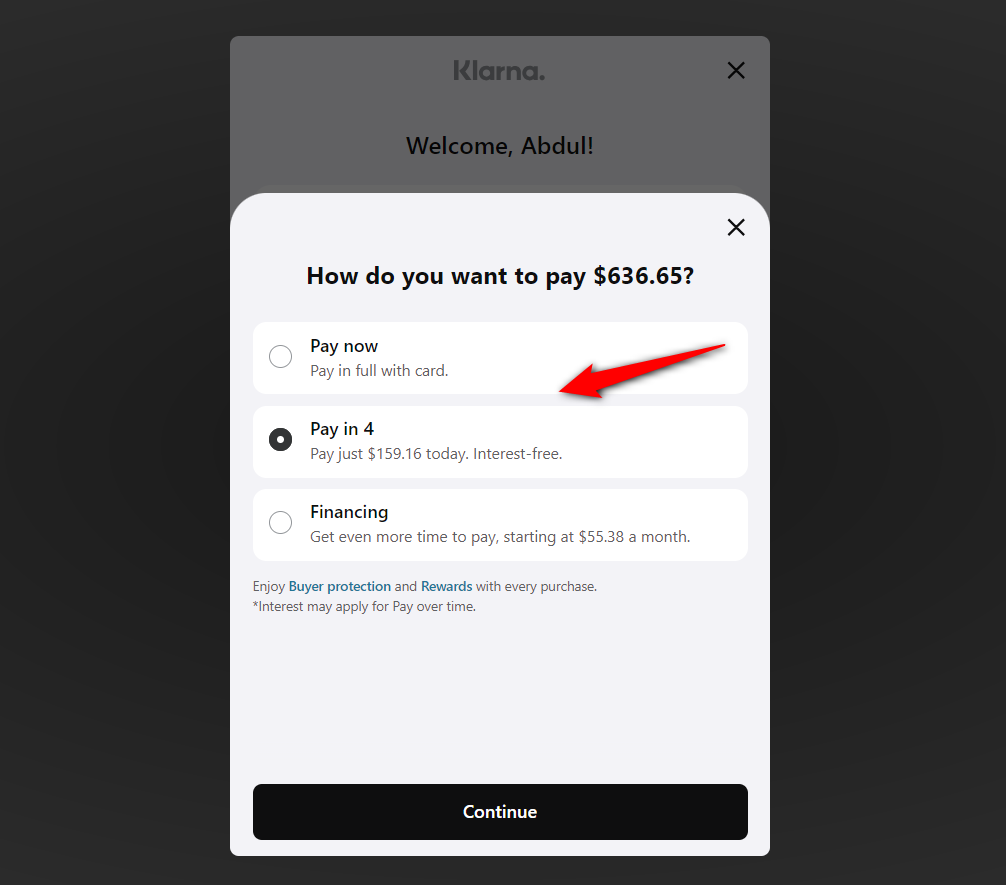

Now, we can choose a payment plan from the available options.

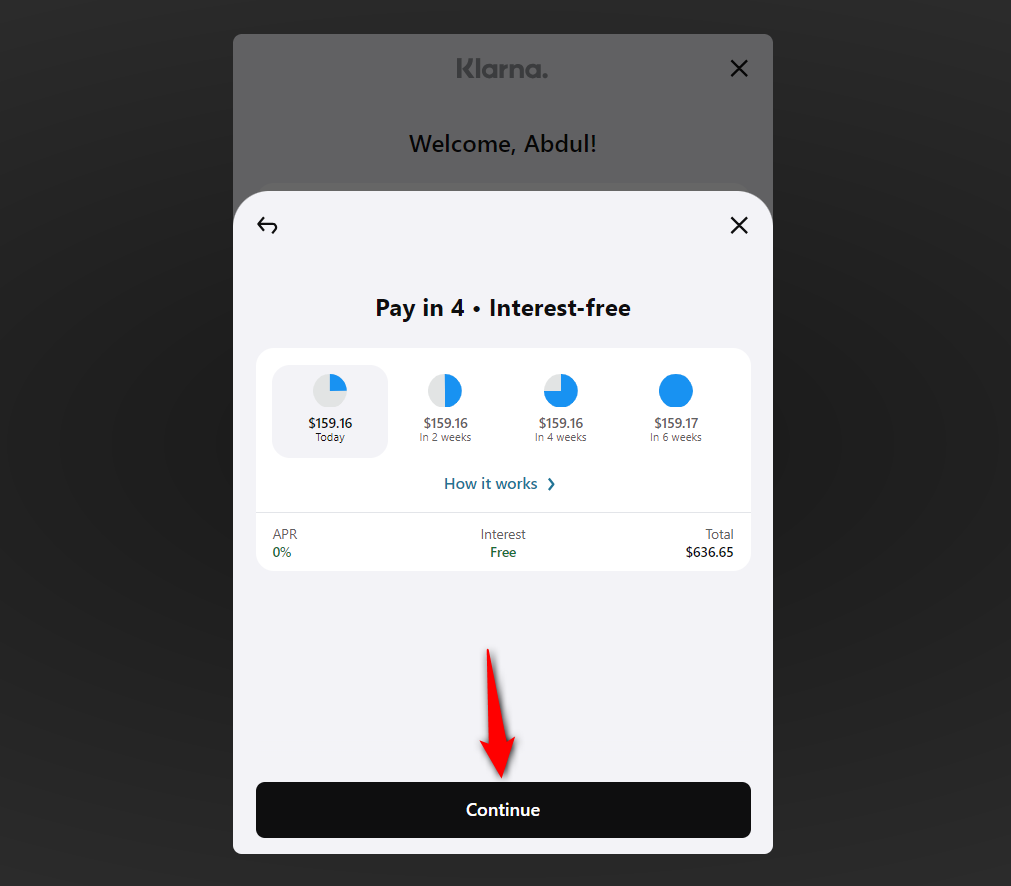

Once you’ve selected the payment plan, it’ll explain the payment that shoppers are needed to pay.

Now, you can review your payment schedule in the final step - this is the amount you’ll have to pay over the coming months.

Once done, hit the ‘Pay today with Klarna’ button to place your order.

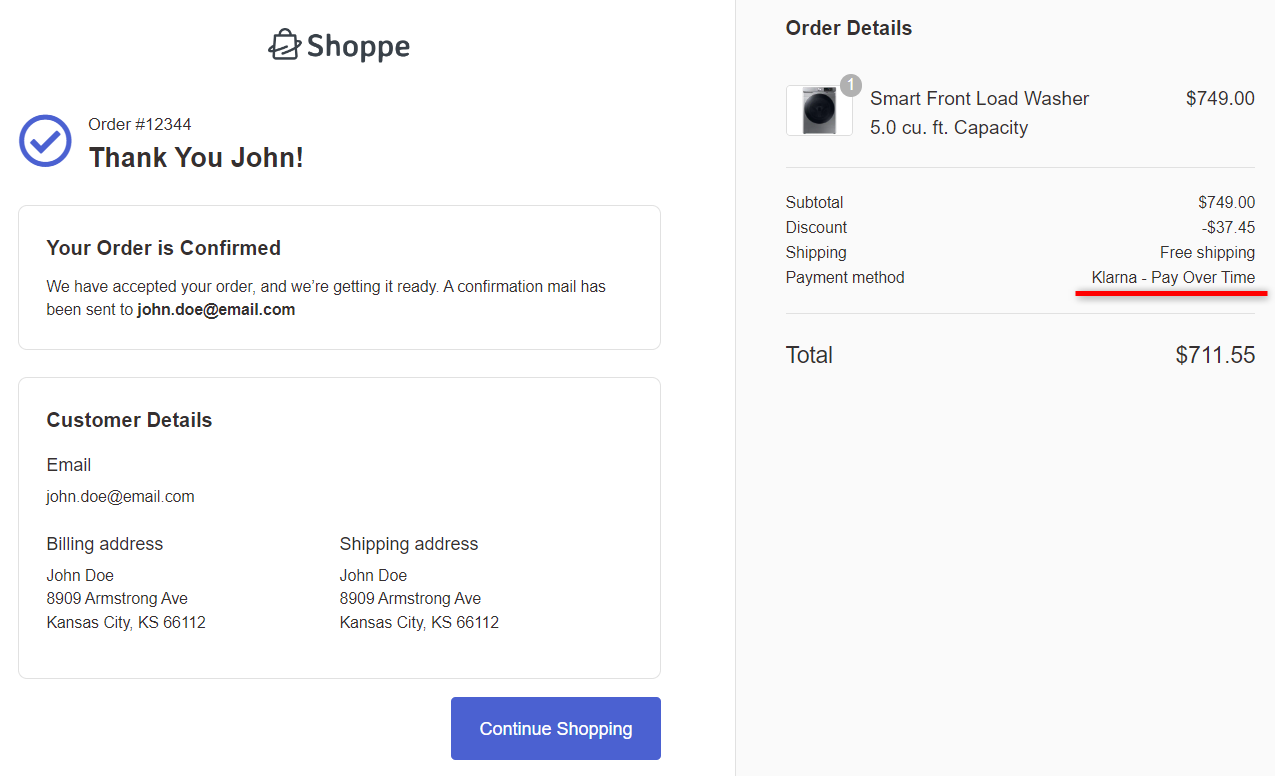

This will place your order and direct you to the thank you page with your complete order confirmation details.

This is how you can test the Buy Now Pay Later payment method in WooCommerce.

The average conversion rate of a default WooCommerce checkout is 0.3%, which is quite low.

The default WooCommerce checkout page looks dull and isn’t designed for conversions. It focuses only on completing the purchase.

That’s why it becomes quite important to customize your checkout page experience.

You can convert this monotonous checkout experience into a conversion-optimized custom checkout flow.

Wondering how?

Well, you can easily do that with the FunnelKit Funnel Builder that too without any coding knowledge.

FunnelKit Funnel Builder is the most powerful sales funnel builder solution for WordPress and WooCommerce. You can create opt-in pages, sales pages, custom checkouts, order bumps, one-click upsells, and thank you pages.

It has the most advanced WooCommerce checkout manager that allows you to customize high-converting checkout pages.

Take a look at the following beautiful checkout page built with FunnelKit:

Further, there are 22+ optimizations that you can implement on your checkout page to process quick payments and boost conversions.

Here, we’ve answered some of the commonly asked questions about BNPL payment methods.

1. Does WooCommerce allow payment plans?

No, WooCommerce, by default, doesn’t offer the option to add payment plans to your store. However, you can use a payment plugin like Stripe Gateway for WooCommerce plugin that integrates different payment methods and offers them to your customers.

2. How do I add Buy Now and Pay Later in WooCommerce?

This answer is similar to different questions like ‘How do I set up pay later?’ or ‘How do I set up a payment plan in WooCommerce?’.

To add Buy Now and Pay Later to WooCommerce, you need a Stripe account and a WooCommerce Stripe gateway plugin installed on your website. Connect your Stripe account and enable BNPL payment methods in your WooCommerce store.

3. Can you use Afterpay with WooCommerce?

Yes, you can use Afterpay with WooCommerce easily with the Stripe Gateway for WooCommerce plugin by FunnelKit. Check our complete WooCommerce Afterpay guide here.

4. How do I add PayPal pay later to WooCommerce?

You can install the WooCommerce PayPal Payments plugin on your website. Configure it on your store and enable the pay later on your WooCommerce checkout page.

5. What are the payment options in WooCommerce?

WooCommerce is the most flexible e-commerce platform that supports a wide range of payment options:

6. What is the installment payment plugin for WooCommerce?

The best installment payment plugin for WooCommerce is the Stripe gateway plugin for WooCommerce. It integrates with Stripe to enable BNPL installment payment methods such as Affirm, Klarna, and Afterpay.

7. Which is the instant payment gateway for WooCommerce?

The instant payment gateway for WooCommerce is the one-click checkout payment methods such as Google Pay and Apple Pay.

8. Are there any risks associated with Buy Now Pay Later?

While Buy Now Pay Later offers massive benefits to customers and merchants, lenders should know the potential risks associated with customers paying for purchases over time. Furthermore, merchants should be aware of the refunds once the BNPL payment is approved.

9. Can customers use Buy Now Pay Later for all purchases?

The availability of Buy Now Pay Later may vary depending on the merchant and eligible products being purchased.

10. Is Buy Now Pay Later available worldwide?

Yes, Buy Now Pay Later payments are increasingly becoming available globally. However, its availability may vary on the region and BNPL payment provider.

If you have any other questions, feel free to ask our Support team and we’ll surely assist you.

Overall, WooCommerce Buy Now Pay Later is a powerful tool for e-commerce businesses looking to drive sales and enhance the customer experience.

Offering BNPL options can be a game changer for merchants to enhance their competitiveness and drive growth.

By understanding the benefits, risks, and best practices associated with BNPL, you can position your business for long-term success.

In addition, you can implement strategies such as designing custom checkout pages and streamlining the checkout process, which can help you stay ahead in the competitive market.

That’s why we recommend you get your hands on the FunnelKit Funnel Builder.

It’s a must-have tool to grow your WooCommerce business and generate massive profits.